Universal Insurance Holdings, Inc. Reports Third-Quarter 2010 Financial Results

Policy Count Increased by Approximately 10,000 During the Third Quarter; Diluted Earnings per Share Improved by 28.6 Percent Compared to the Same Quarter of 2009; Stockholders’ Equity Increased 12.2 Percent During the Third Quarter

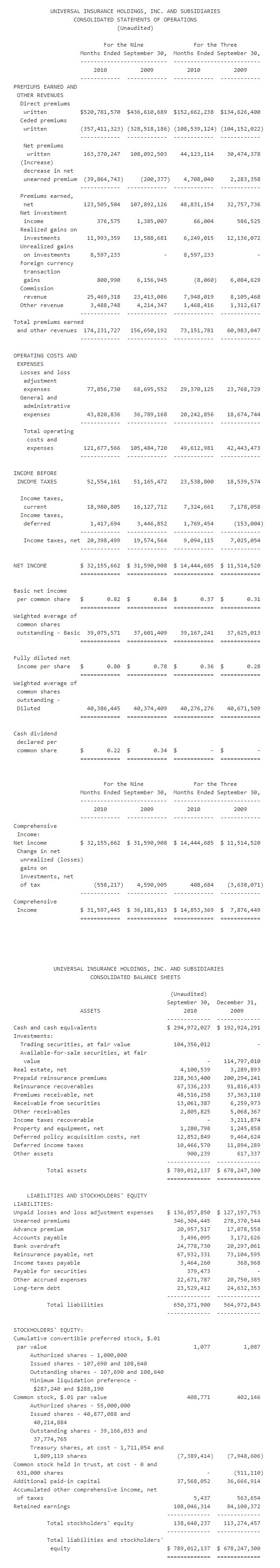

FORT LAUDERDALE, FL–(Marketwire – November 9, 2010) – Universal Insurance Holdings, Inc. (the Company or Universal) (NYSE Amex: UVE), a vertically integrated insurance holding company, announced third-quarter 2010 net income of $14.4 million, or $0.36 per diluted share, compared to $11.5 million, or $0.28 per diluted share, during the same period of 2009.

Net income and diluted earnings per share increased 25.4 and 28.6 percent, respectively, for the 2010 third quarter compared to the same period last year. The improvement in operating results is primarily attributable to an increase in net premiums earned. Realized and unrealized gains on investments also positively impacted overall financial results. The improved profitability was moderated by state-mandated wind mitigation credits, lower foreign currency transaction gains, and increased operating costs and expenses.

Homeowners’ and dwelling fire insurance policies serviced by Universal Property & Casualty Insurance Company (UPCIC), the Company’s wholly-owned subsidiary, and the related direct premiums written, increased during the third quarter of 2010 compared to the same period of 2009. Recent rate increases in Florida, 14.6 percent statewide for its homeowners’ program and 14.8 percent statewide for its dwelling fire policies, increased premiums and improved profitability. UPCIC also continued to recoup a portion of the $4.1 million Florida Insurance Guaranty Association (FIGA) assessment incurred in 2009.

During the 2010 third quarter, UPCIC’s policy count continued to grow. At September 30, 2010, UPCIC serviced approximately 576,000 homeowners’ and dwelling fire insurance policies, up from 566,000 policies at June 30, 2010, and 536,000 policies at September 30, 2009. The increase in the number of policies in-force is the result of heightened relationships with existing agents, an increase in the number of new agents, as well as continued expansion within Florida, South Carolina, North Carolina, and Hawaii. Within South Carolina, North Carolina, and Hawaii, UPCIC had nearly 8,300 policies totaling approximately $11.6 million of in-force premiums at September 30, 2010.

Net premiums earned increased 49.1 percent in the third quarter of 2010 compared to the same quarter in 2009, primarily as a result of greater net premiums written. Meanwhile, third-quarter 2010 operating costs and expenses were higher compared to the third quarter of last year, as losses and loss adjustment expenses increased 23.6 percent and general and administrative expenses increased 8.4 percent. The increase in losses and loss adjustment expenses is related to the servicing of additional policies due to the growth in policy count on a year-over-year basis. The increase in general and administrative expenses was primarily attributable to increases in commissions on direct premiums and insurance premium taxes, which are a result of an increase in direct written premiums from growth in the number of policies in-force and increases in the average in-force premium per policy. These increased expenses were partially offset by an increase in ceding commissions.

At September 30, 2010, stockholders’ equity increased to $138.6 million from $123.6 million at June 30, 2010, representing growth of 12.2 percent.

Investment Portfolio Update

Realized gains on investments were $6.2 million for the third quarter of 2010 and unrealized gains on investments for the third quarter of 2010 were $8.6 million. During the third quarter of 2010, the Company evaluated the trading activity in its investment portfolio and its overall investment program. As a result of this evaluation, the Company reclassified its available-for-sale portfolio as a trading portfolio effective July 1, 2010. Accordingly, unrealized gains on investments were recognized as income during the third quarter of 2010, relating to the reclassification of the Company’s investments to a trading portfolio from an available-for-sale portfolio. The Company will continue to record future changes in the market value of its trading portfolio directly to revenues as unrealized gains on investments. The reclassification of the Company’s available-for-sale investment portfolio to a trading securities portfolio increased net income and diluted earnings per share by $5.3 million and $0.13, respectively, during the third quarter of 2010.

As of September 30, 2010, the Company’s investments in trading securities totaled $104.4 million, compared to fixed maturities and equity securities available for sale of $137.9 million at June 30, 2010. At September 30, 2010, approximately 90.8 percent of the investments in trading securities were in equity securities and 9.2 percent were in fixed maturities.

Cash Dividend

On October 6, 2010, Universal’s board of directors declared a cash dividend of $0.10 per share, which was paid on November 5, 2010, to shareholders of record as of October 22, 2010.

About Universal Insurance Holdings, Inc.

Universal Insurance Holdings, Inc. is a vertically integrated insurance holding company, which through its subsidiaries, covers substantially all aspects of insurance underwriting, distribution, claims processing and exposure management. Universal Property & Casualty Insurance Company (UPCIC), a wholly owned subsidiary of the Company, is one of the five leading writers of homeowners’ insurance in Florida and is now fully licensed and has commenced its operations in Hawaii, North Carolina and South Carolina. For additional information on the Company, please visit our investor relations website at www.universalinsuranceholdings.com.

Forward-Looking Statements and Risk Factors

This press release may contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. The words “believe,” “expect,” “anticipate,” and similar expressions identify forward-looking statements, which speak only as of the date the statement was made. Such statements may include commentary on plans, products and lines of business, marketing arrangements, reinsurance programs and other business developments and assumptions relating to the foregoing. Forward-looking statements are inherently subject to risks and uncertainties, some of which cannot be predicted or quantified. Future results could differ materially from those described and the Company undertakes no obligation to correct or update any forward-looking statements. For further information regarding risk factors that could affect the Company’s operations and future results, refer to the Company’s reports filed with the Securities and Exchange Commission, including the Form 10-K for the year ended December 31, 2009 and the Form 10-Q for the quarter ended September 30, 2010.

Investor Contact:

Philip Kranz Dresner Corporate Services 312-780-7240 pkranz@dresnerco.com