Universal Insurance Holdings, Inc. Reports Third-Quarter and Nine-Months 2007 Financial Results

FORT LAUDERDALE, FL — (MARKET WIRE) — 11/14/2007 — Universal Insurance Holdings, Inc. (UIH) (AMEX: UVE)

-- Total premiums earned and other revenues increase to $45.7 million in

the quarter, up from $19.3 million last year

-- Earnings per diluted share of 33 cents in the quarter versus 10 cents

last year

-- Excluding FIGA assessment of $7.4 million, earnings per diluted share

totaled 44 cents in the quarter, up 340 percent year over year

-- Shareholders equity increased to $63.6 million at September 30, 2007,

up from $22.0 million at December 31, 2006

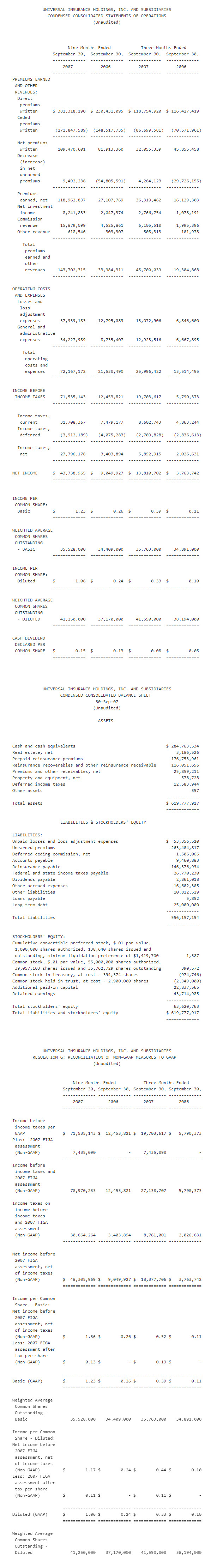

Universal Insurance Holdings, Inc. (UIH) (AMEX: UVE), a vertically integrated insurance holding company, announced third-quarter 2007 net income of $13.8 million, or $0.33 per diluted share, compared to $3.8 million, or $0.10 per diluted share, in the third quarter of 2006. On October 11, 2007, the Board of Directors of the Florida Insurance Guaranty Association (FIGA) determined the need for an assessment upon member companies of 2.0 percent of the Florida net direct premiums for the calendar year 2006. Universal Property & Casualty Insurance Company’s (UPCIC’s) participation in this assessment totaled $7.4 million, which reduced net income by $4.6 million, or $0.11 per diluted share in the third quarter period ended September 30, 2007. Excluding the FIGA assessment, the Company’s net income was $18.4 million in the 2007 third quarter, while earnings per diluted share were $0.44 in the third quarter 2007 period versus $0.10 in the same period last year. Pursuant to Florida statutes, UPCIC is permitted to recoup the assessment by adding a surcharge to policies in an amount not to exceed the amount paid by the insurer to FIGA, which will be assessed as part of 2008 premiums.

Gross premiums written increased 2.0 percent to $118.8 million in the third quarter of 2007 from $116.4 million for the same period of 2006, primarily attributable to an increase in new business as well as premium rate increases. Increased new business is due to heightened relationships with existing agents, an increase in new agents, a new web-based policy administration platform, and the disruption in the marketplace as a result of the windstorm catastrophes in 2004 and 2005.

In the 2007 third quarter, net premiums earned increased 125.2 percent to $36.3 million from $16.1 million in the 2006 third quarter, due primarily to an increase in new business, premium rate increases, and changes in the Company’s reinsurance program.

Investment income increased 156.6 percent to $2.8 million for the three-month period ended September 30, 2007, from $1.1 million for the three-month period ended September 30, 2006. The increase is primarily due to higher investment balances and a higher interest rate environment during the 2007 period.

Comparing the third quarter of 2007 with the same period of 2006, commission revenue increased 206.0 percent to $6.1 million from $2.0 million due mainly to an increase in the managing general agent’s policy fee income and a greater amount of reinsurance commission sharing.

Net losses and loss adjustment expenses (LAE) increased 90.9 percent to $13.1 million in the 2007 third quarter from $6.8 million in the same period of 2006. Losses and LAE increased as a result of increased premium volume and changes in the Company’s reinsurance program. The Company’s net loss ratio for the three-month period ended September 30, 2007, was 36.0 percent compared to 42.5 percent for the same period ended September 30, 2006.

Third-quarter general and administrative expenses increased 93.8 percent to $12.9 million in the 2007 period from $6.7 million in the 2006 period. The increase in general and administrative expenses was due to several factors, including increased commission expense of $0.3 million due to the increase in direct written premium, and increased compensation expense of nearly $2.7 million as the Company hired additional staff and increased incentive compensation in order to retain existing staff to support the substantial growth of the Company.

Also impacting third-quarter 2007 general and administrative expenses was the FIGA assessment mentioned earlier. UPCIC’s participation in the FIGA assessment totaled $7.4 million, or 2.0 percent of the Company’s net direct premiums for calendar year 2006. This assessment reduced basic and diluted earnings per share by $0.13 and $0.11, respectively. Pursuant to Florida statutes, UPCIC is permitted to recoup the assessment by adding a surcharge to policies in an amount not to exceed the amount paid by the insurer to FIGA.

These increases in third-quarter 2007 general and administrative expenses were somewhat offset by a decrease of approximately $2.5 million for the change in deferred policy acquisition costs, net of deferred ceding commissions. This decrease relates to an increase in direct and ceded unearned premiums as well as changes in UPCIC’s reinsurance program.

During the third quarter of 2007, the Company’s balance sheet improved, as total assets were $619.8 million versus $481.6 million at December 31, 2006. For the period ended September 30, 2007, stockholders equity increased to $63.6 million from $22.0 million at December 31, 2006, and total debt was reduced to $25.0 million from $37.4 million at December 31, 2006.

As of September 30, 2007, the Company was servicing approximately 365,000 homeowners’ and dwelling fire insurance policies and in-force premiums of approximately $526 million, while its statutory capital and surplus was $92.0 million.

Nine-Month Results

Nine-month 2007 net income was $43.7 million, or $1.06 per diluted share, compared to $9.0 million, or $0.24 per diluted share, in the same period of 2006. Excluding the FIGA assessment incurred in the third quarter of 2007, net income for the nine month period of 2007 was $48.3 million versus net income of $9.0 million for the nine month period of 2006, while earnings per diluted share were $1.17 in the 2007 nine month period versus $0.24 in the 2006 nine month period.

In the nine months of 2007, gross premiums written increased 65.5 percent to $381.3 million from $230.4 million for the same period of 2006, primarily attributable to an increase in new business as well as premium rate increases. In the 2007 nine-month period, net premiums earned increased 338.9 percent to $119.0 million from $27.1 million in the 2006 period, due primarily to an increase in new business, premium rate increases and changes in the reinsurance program.

Investment income increased 302.6 percent to $8.2 million for the nine-month period ended September 30, 2007, from $2.0 million for the nine-month period ended September 30, 2006. The increase is primarily due to higher investment balances and a higher interest rate environment during the 2007 period.

Comparing the nine months of 2007 with the same period of 2006, commission revenue increased 250.9 percent to $15.9 million from $4.5 million due mainly to an increase in the managing general agent’s policy fee income and a greater amount of reinsurance commission sharing.

Net losses and LAE increased 196.5 percent to $37.9 million in the 2007 nine months compared to $12.8 million in the same period of 2006. Losses and LAE increased as a result of increased premium volume and changes in the Company’s reinsurance program. The Company’s net loss ratio for the nine-month period ended September 30, 2007, was 31.9 percent compared to 47.2 percent for the same period ended September 30, 2006.

Nine-month general and administrative expenses increased 294.3 percent to $34.2 million in the 2007 period from $8.7 million in the 2006 period.

The Company announced on October 4, 2007, a cash dividend on its common stock. Stockholders of record as of March 10, 2008, will receive $0.09 for each share owned on that date, payable on April 8, 2008.

Management Comments

Bradley I. Meier, president and chief executive officer, commented, “We are extremely pleased with the third-quarter and nine-month results for 2007, which included diluted earnings per share growth of 340% and 388%, respectively, prior to the $7.4 million FIGA assessment, which amounted to $0.11 per diluted share. These solid results are testimony to the business infrastructure we have built over the past several years.”

Mr. Meier concluded, “We remain focused on growing the Company, as UPCIC is in the process of preparing Certificate of Authority applications to write homeowners’ insurance policies in five additional states including Texas, Hawaii, Georgia, South Carolina, and North Carolina. Additionally, UPCIC is in the process of preparing an application to become a National Flood Insurance Program (NFIP) servicing agent.”

About Universal Insurance Holdings, Inc.

The Company is a vertically integrated insurance holding company operating solely in the state of Florida. Through its subsidiaries, the Company is currently engaged in insurance underwriting, distribution and claims. Universal Property & Casualty Insurance Company (UPCIC), which generates revenue from the collection and investment of premiums, is one of the top 5 leading writers of homeowners’ insurance in the state of Florida and has aligned itself with well respected service providers in the industry.

Readers should refer generally to reports filed by the Company with the Securities and Exchange Commission (SEC), and specifically to the Company’s Form 10-KSB for the year ended December 31, 2006 for a discussion of the risk factors that could affect its operations. Such factors include, without limitation, exposure to catastrophic losses; reliance on the Company’s reinsurance program; underwriting performance on catastrophe and non-catastrophe risks; the ability to maintain relationships with customers, employees or suppliers; and competition and its effect on pricing, spending, third-party relationships and revenues. Additional factors that may affect future results are contained in the Company’s filings with the SEC, which are available on the SEC’s web site at https://www.sec.gov. The Company disclaims any obligation to update and revise statements contained in this press release based on new information or otherwise.

Cautionary Language Concerning Forward-Looking Statements

This press release contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. The words “remain committed,” “believe,” “expect,” “anticipate” and “project,” and similar expressions identify forward-looking statements, which speak only as of the date the statement was made. Such statements may include, but not be limited to, projections of revenues, income or loss, expenses, plans, and assumptions relating to the foregoing. Forward-looking statements are inherently subject to risks and uncertainties, some of which cannot be predicted or quantified. Future results could differ materially from those described in forward-looking statements.

Philip Kranz Dresner Corporate Services 312-780-7240 pkranz@dresnerco.com