Universal Insurance Holdings, Inc. Reports First-Quarter 2009 Financial Results

UPCIC Policy Counts Grow by 37,000 in the Quarter Compared to December 31, 2008; Book Value per Share Increased 7 Percent Compared to December 31, 2008; Cash Dividends of 22 Cents Declared to Date in 2009

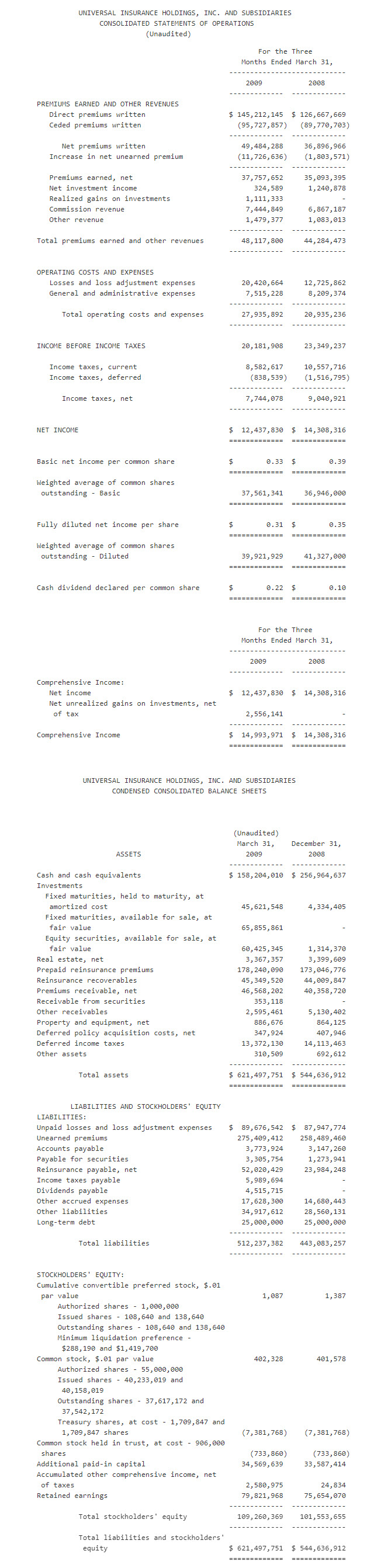

FORT LAUDERDALE, FL — (MARKET WIRE) — 05/11/2009 — Universal Insurance Holdings, Inc. (“the Company”) (NYSE Amex: UVE), a vertically integrated insurance holding company, announced first-quarter 2009 net income of $12.4 million, or $0.31 per diluted share, compared to $14.3 million, or $0.35 per diluted share, in the first quarter of 2008.

First Quarter 2009 Results

UPCIC, the Company’s wholly-owned regulated insurance subsidiary, saw continued growth in its policy count, servicing approximately 498,000 homeowners’ and dwelling fire insurance policies as of March 31, 2009, up from 461,000 policies and 399,000 policies at December 31, 2008, and March 31, 2008, respectively. The increase in the number of policies in-force continues to be the result of heightened relationships with existing agents, an increase in new agents, a new web-based policy administration platform, and the continued disruption in the Florida marketplace. Additionally, as announced in December 2008, UPCIC has started to write homeowners’ insurance policies in South Carolina, and as of March 31, 2009 it has written approximately 165 policies totaling $342,000 of in-force premiums.

In-force premiums were approximately $534.3 million as of March 31, 2009, versus $504.0 million at March 31, 2008, while gross premiums written were $145.2 million in the first quarter of 2009, compared to $126.7 million for the same period of 2008. In-force premiums at December 31, 2008 were approximately $518.2 million.

Notwithstanding the growth in the number of homeowners’ and dwelling fire insurance policies serviced by UPCIC and related growth in gross premiums written during the 2009 first quarter, the Company experienced a decrease in net income in the current period primarily as a result of the effects of state mandated rate reductions and wind mitigation discounts, and increased non-catastrophe losses and loss adjustment expenses incurred.

As the Company has previously discussed, a rate decrease required by the Florida Legislature resulted in rate decreases averaging 11.1 percent statewide on homeowners’ policies and 2.3 percent statewide on dwelling fire policies, and were integrated into UPCIC’s rates on June 1, 2007. The effect of these rate decreases on existing policies and the corresponding premium decreases in direct written premium was fully recognized in UPCIC’s policies by May 31, 2008. Also, rate decreases of 4.1 percent statewide for homeowners’ policies and 0.2 percent statewide for dwelling fire policies were required by the Florida Legislature and implemented with effective dates in January 2008 for the homeowners’ program and March 2008 for the dwelling fire program. The effect of these rate decreases on existing policies and the corresponding premium decreases in direct written premium was fully recognized in UPCIC’s policies by January 2009 for the homeowners’ program and March 2009 for the dwelling fire program. Finally, in February 2009 rate increases of 4.8 percent statewide for homeowners’ policies and 4.7 percent statewide for dwelling fire policies were approved by the Florida Office of Insurance Regulation (“OIR”) and were implemented with effective dates of February 27, 2009, for new business and April 19, 2009, for renewal business. Despite the most recent rate increases, the cumulative effect of the prior rate decreases had an adverse effect on UPCIC’s premium growth during the 2009 first quarter.

Additionally, UPCIC recognized a higher volume of premium discounts in response to a state-required wind mitigation discount program available to policyholders. Such discounts, which were required by the Florida Legislature and became effective on June 1, 2007, for new business, and August 1, 2007, for renewal business, have also had a continued significant negative effect on UPCIC’s premium volume. As of March 31, 2008, 16.9 percent of UPCIC policyholders were receiving wind mitigation credits totaling $52.4 million, (a 10.4 percent reduction of in-force premium), while 36.3 percent of UPCIC policyholders were receiving wind mitigation credits totaling $158.2 million, (a 29.8 percent reduction of in force premium), at March 31, 2009.

Nonetheless, net premiums earned increased 7.6 percent to $37.8 million in the first quarter of 2009, from $35.1 million in the 2008 first quarter, as a result of an increase in direct premiums earned (net of previously discussed rate decreases and implementation of higher wind mitigation credits).

Net investment income decreased 73.8 percent to $324,589 for the three-month period ended March 31, 2009, from $1.2 million for the three-month period ended March 31, 2008. Net investment income is comprised primarily of interest and dividends. The decrease is primarily due to changes in the composition of the Company’s investment portfolio during the three-month period ended March 31, 2009.

Realized gains on investments increased 100.0 percent to $1.1 million for the three-month period ended March 31, 2009, from zero realized gains on investments for the three-month period ended March 31, 2008. The increase is due to the expansion of the Company’s investment portfolio into equity securities and the related sales of these securities.

Commission revenue increased 8.4 percent to $7.4 million in the 2009 first quarter, from $6.9 million in the same quarter last year. Commission revenue is comprised principally of the managing general agent’s policy fee income and service fee income on all new and renewal insurance policies, reinsurance commission sharing agreements, and commissions generated from agency operations. The increase is primarily attributable to a decrease in reinsurance commission sharing of approximately $391,000 and an increase in managing general agent’s policy fee income of approximately $973,000.

Other revenue increased 36.6 percent to $1.5 million in the 2009 first quarter, from $1.1 million in the 2008 period, primarily attributable to growth in fees earned on new payment plans offered to policyholders by UPCIC.

In the first quarter of 2009, net losses and loss adjustment expenses (LAE) increased 60.5 percent to $20.4 million from $12.7 million in the first quarter of 2008. The net loss ratio, which is derived from net losses and LAE as a percentage of net earned premium, for the three-month period ended March 31, 2009, was 54.1 percent compared to 36.3 percent for the same quarter of 2008. The increase in the net loss ratio is primarily attributable to the increase in direct loss and LAE incurred outpacing the increase in direct earned premium in the 2009 quarter as compared to the 2008 quarter.

Although total direct premiums earned increased 2.7 percent in the 2009 first quarter compared to the same quarter in 2008, the average premium per policy decreased significantly due to the previously described rate decreases and wind mitigation credits. At March 31, 2009, UPCIC was servicing approximately 498,000 homeowners’ and dwelling fire insurance policies with in-force premiums of approximately $534.3 million, or an average of $1,073 per policy, while the amount of policies UPCIC was servicing at the comparable quarter of 2008 was approximately 399,000 with in-force premiums of approximately $504.0 million, or an average of $1,262. Consequently, as a result of increased net losses and LAE in connection with the servicing of additional policies, the direct loss and LAE ratio increased significantly for the 2009 period. Additionally, although the per unit price of reinsurance has decreased, total reinsurance costs are higher as UPCIC purchased additional coverage for the June 1, 2008 through May 31, 2009 period.

First-quarter 2009 general and administrative expenses decreased 8.5 percent to $7.5 million from $8.2 million in the 2008 first quarter. The decrease in general and administrative expenses was the result of several factors including an increase in ceding commissions due to greater ceded earned premiums, a decrease in assessment expense, and a decrease in interest expense.

The Company’s income taxes decreased 14.3 percent to $7.7 million, or 38.4 percent of pre-tax income, in the 2009 first quarter, from $9.0 million, or 38.7 percent of pre-tax income, for the same period of 2008. The decrease in income taxes is primarily due to lower pre-tax income in the 2009 period versus the same period in 2008.

At March 31, 2009, stockholders’ equity increased to $109.3 million from $101.6 million at December 31, 2008, representing growth of 7.6 percent. As of March 31, 2009, UPCIC’s statutory capital and surplus was $98.5 million versus $94.0 million at December 31, 2008.

Investment Portfolio

The Company’s investment portfolio includes a greater level of fixed maturities and equity securities at March 31, 2009, as compared to December 31, 2008, and earlier periods in order to more conservatively limit its exposure to the volatility in the current banking environment. The Company’s investment objective is to maximize total rate of return after federal income taxes while maintaining liquidity and minimizing risk. The Company’s current investment policy, which limits investments in non-investment grade fixed maturity securities (including high-yield bonds), and limits total investments in preferred stock and common stock, complies with applicable laws and regulations, which further restrict the type, quality and concentration of investments.

The Company’s Investment Committee, consisting of all current directors, establishes and reviews on a regular basis the Company’s investment policy in addition to managing the investment portfolio in accordance with guidelines established by the Florida OIR. Pursuant to this investment policy, as of March 31, 2009, approximately 26.5 percent of investments were in fixed maturities and short-term investments, which are intended to be held until maturity, based upon the Company’s estimates of required liquidity. Approximately 38.3 percent of the investments were in fixed maturities available for sale and 35.2 percent in equity securities considered available for sale, based upon the Company’s estimates of required liquidity. Furthermore, the equity security position is comprised of holdings in commodity type areas including energy, precious metals, and agriculture. At this time the Company does not use any swaps, options, futures or forward contracts to hedge or enhance the investment portfolio.

At March 31, 2009, the Company had net unrealized gains on investments, net of tax, of $2.6 million, as compared to no net unrealized gains on investments, net of tax as of March 31, 2008.

Management Comments

Bradley I. Meier, president and chief executive officer, commented, “We are pleased with the continued growth in UPCIC’s homeowners’ policies and the continued profitability of the Company, despite the effect of Florida mandated rate decreases and wind mitigation credits across UPCIC’s book of business. The Company’s profitability has afforded it the opportunity to pay dividends of 22 cents per common share thus far in 2009, while also allowing for continued growth in book value per share.”

Mr. Meier concluded, “We are proud of the progress we have made to date in 2009 with respect to our expansion plans. UPCIC recently received approval of its rates and forms from the North Carolina Department of Insurance to write homeowners’ insurance in the State of North Carolina, and on April 20, 2009 UPCIC wrote its first homeowners’ insurance policy in the state. Also, on April 24, 2009, UPCIC received approval of its rates and forms from the insurance division of Hawaii’s Department of Commerce and Consumer Affairs and will begin writing homeowners’ policies in the State of Hawaii shortly. Finally, on May 8, 2009, the Company filed an application to the Texas Department of Insurance to form a separate property and casualty insurance subsidiary to write homeowners’ coverage in Texas.”

About Universal Insurance Holdings, Inc.

Universal Insurance Holdings, Inc. (UIH) is a vertically integrated insurance holding company, which through its various subsidiaries, covers substantially all aspects of insurance underwriting, distribution, claims processing and exposure management. Universal Property & Casualty Insurance Company (UPCIC), a wholly owned subsidiary of UIH, is one of the five leading writers of homeowners’ insurance in Florida and is now fully licensed and has commenced its operations in Georgia, Hawaii, North Carolina and South Carolina. Additionally, the Company has also filed an application to the Texas Department of Insurance to form a separate property and casualty subsidiary to write homeowners’ insurance coverage in Texas.

Readers should refer generally to reports filed by the Company with the Securities and Exchange Commission (SEC), specifically the Company’s Form 10-K for the year ended December 31, 2008, and the Company’s Form 10-Q for the quarterly period ended March 31, 2009, for a discussion of the risk factors that could affect its operations. Such factors include, without limitation, exposure to catastrophic losses; reliance on the Company’s reinsurance program; underwriting performance on catastrophe and non-catastrophe risks; the ability to maintain relationships with customers, employees or suppliers; competition and its effect on pricing, spending and third-party relationships; the Company’s financial stability rating; product pricing and revenues; and the effect of Federal or state laws and regulations. Additional factors that may affect future results are contained in the Company’s filings with the SEC, which are available on the SEC’s web site at https://www.sec.gov. The Company disclaims any obligation to update and revise statements contained in this press release based on new information or otherwise.

Cautionary Language Concerning Forward-Looking Statements

This press release contains “forward-looking statements” that anticipate results based on our estimates, assumptions and plans that are subject to uncertainty. These statements are made subject to the safe-harbor provisions of the Private Securities Litigation Reform Act of 1995. We assume no obligation to update any forward-looking statements as a result of new information or future events or developments.

These forward-looking statements do not relate strictly to historical or current facts and may be identified by their use of words like “plans,” “seeks,” “expects,” “will,” “should,” “anticipates,” “estimates,” “intends,” “believes,” “likely,” “targets” and other words with similar meanings. These statements may address, among other things, our strategy for growth, catastrophe exposure management, product development, investment results, regulatory approvals, market position, expenses, financial results, litigation and reserves. We believe that these statements are based on reasonable estimates, assumptions and plans. However, if the estimates, assumptions or plans underlying the forward-looking statements prove inaccurate or if other risks or uncertainties arise, actual results could differ materially from those communicated in these forward-looking statements.

Philip Kranz Dresner Corporate Services 312-780-7240 pkranz@dresnerco.com