Universal Insurance Holdings, Inc. Reports First-Quarter 2011 Financial Results

First-Quarter 2011 Diluted Earnings per Share Doubled Over Last Year; Stockholders’ Equity Increased 7.4 Percent During the First Quarter

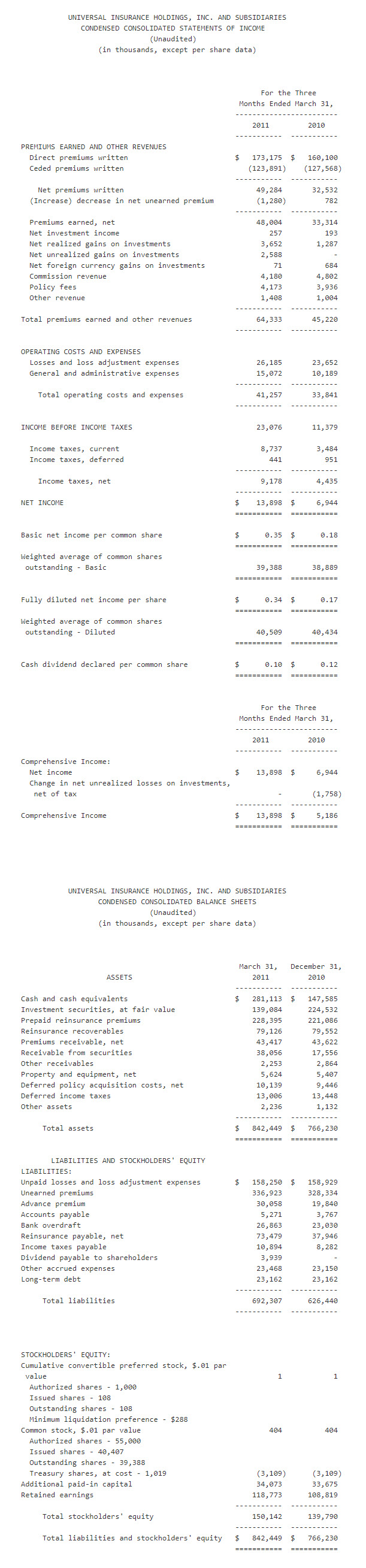

FORT LAUDERDALE, FL–(Marketwire – May 9, 2011) – Universal Insurance Holdings, Inc. (the Company or Universal) (NYSE Amex: UVE), a vertically integrated insurance holding company, reported net income of $13.9 million, or $0.34 per diluted share, in the first quarter of 2011, compared to net income of $6.9 million, or $0.17 per diluted share, for the same period in 2010.

First-Quarter 2011 Results

Net income and diluted earnings per share both doubled in the 2011 first quarter compared to the same period last year. The improvement in operating results is primarily attributable to an increase in net premiums earned. Net realized and unrealized gains on investments also positively contributed to the overall financial results. The improved profitability was moderated by state-mandated wind mitigation credits within the state of Florida and higher operating costs and expenses.

Homeowners’ and dwelling fire insurance policies serviced by Universal Property & Casualty Insurance Company (UPCIC), the Company’s wholly-owned subsidiary, and the related direct premiums written, increased during the first quarter of 2011 compared to the same period of 2010. The fourth-quarter 2009 premium rate increases in Florida, which were 14.6 percent statewide for UPCIC’s homeowners’ program and 14.8 percent statewide for its dwelling fire policies, increased premiums and improved profitability in the first quarter of 2011. Additionally, the premium rate increase of 14.9 percent statewide for UPCIC’s homeowners’ insurance program within the state of Florida announced February 2011 has started to flow through UPCIC’s book of business. The effective dates for the rate increase were February 7, 2011, for new business and March 28, 2011, for renewal business. UPCIC expects the approved premium rate increase to have a favorable effect on premiums written and earned in future months, as new and renewal policies are written at the higher rates.

During the 2011 first quarter, UPCIC’s policy count continued to grow. At March 31, 2011, UPCIC serviced approximately 593,000 homeowners’ and dwelling fire insurance policies, up from approximately 584,000 policies at December 31, 2010, and approximately 544,000 policies at March 31, 2010. The increase in the number of policies in-force is the result of strengthened relationships with existing agents, an increase in the number of new agents, as well as continued expansion within Florida, South Carolina, North Carolina, and Hawaii. Within South Carolina, North Carolina, and Hawaii, UPCIC had approximately 10,000 policies totaling approximately $13.7 million of in-force premiums at March 31, 2011.

Net premiums earned increased 44.1 percent in the first quarter of 2011 compared to the same quarter in 2010, primarily as a result of greater net premiums written, which were positively affected by policy count growth and the premium rate increases in Florida.

Operating costs and expenses for the first quarter of 2011 were higher compared to the first quarter of last year, as losses and loss adjustment expenses (LAE) increased 10.7 percent, and general and administrative expenses increased 47.9 percent. The increase in losses and LAE is due to the growth in policy count on a year-over-year basis. General and administrative expenses increased primarily in response to an increase in commissions paid on direct written premium and the associated premium taxes thereon. Commissions and premium taxes are directly related to the volume of direct written premium. As noted previously, direct written premium has increased in response to an increase in the number of policies-in-force and the increase in in-force premium per policy. Increased expenses were partially offset by an increase in ceding commissions.

At March 31, 2011, stockholders’ equity increased to $150.1 million from $139.8 million at December 31, 2010, and $114.8 million at March 31, 2010, representing growth of 7.4 percent and 30.8 percent, respectively.

Investment Portfolio Update

For the first quarter of 2011, net realized gains on investments were $3.7 million, and net unrealized gains on investments were $2.6 million. As of March 31, 2011, the Company’s investment securities, at fair value, totaled $139.1 million, compared to $224.5 million at December 31, 2010. At March 31, 2011, 58 percent of the investment securities, at fair value, were in equity securities and 42 percent were in debt securities. At March 31, 2011, the Company’s cash and cash equivalents totaled $281.1 million as compared to $147.6 million at December 31, 2010.

About Universal Insurance Holdings, Inc.

Universal Insurance Holdings, Inc. is a vertically integrated insurance holding company, which through its subsidiaries, covers substantially all aspects of insurance underwriting, distribution, claims processing and exposure management. Universal Property & Casualty Insurance Company (UPCIC), a wholly owned subsidiary of the Company, is one of the five leading writers of homeowners’ insurance in Florida and is now fully licensed and has commenced its operations in Hawaii, North Carolina and South Carolina. For additional information on the Company, please visit our investor relations website at www.universalinsuranceholdings.com.

Forward-Looking Statements and Risk Factors

This press release may contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. The words “believe,” “expect,” “anticipate,” and similar expressions identify forward-looking statements, which speak only as of the date the statement was made. Such statements may include commentary on plans, products and lines of business, marketing arrangements, reinsurance programs and other business developments and assumptions relating to the foregoing. Forward-looking statements are inherently subject to risks and uncertainties, some of which cannot be predicted or quantified. Future results could differ materially from those described and the Company undertakes no obligation to correct or update any forward-looking statements. For further information regarding risk factors that could affect the Company’s operations and future results, refer to the Company’s reports filed with the Securities and Exchange Commission, including the Form 10-K for the year ended December 31, 2010 and the Form 10-Q for the quarter ended March 31, 2011.

Investor Contact:

Philip Kranz

Dresner Corporate Services

312-780-7240

pkranz@dresnerco.com