Universal Insurance Holdings, Inc. Reports Fourth-Quarter and Full-Year 2009 Financial Results

Subsidiary UPCIC Plans to Apply for Expansion Into Five Additional States

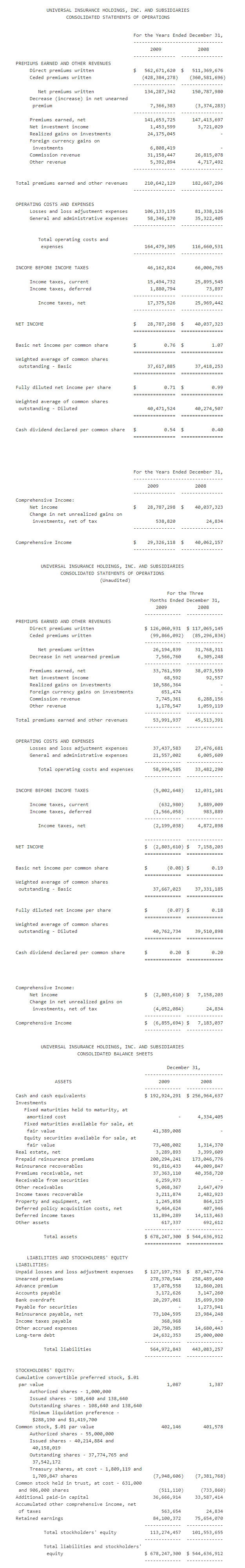

FORT LAUDERDALE, FL–(Marketwire – March 16, 2010) – Universal Insurance Holdings, Inc. (the Company or Universal) (NYSE Amex: UVE), a vertically integrated insurance holding company, reported net income of $28.8 million, or $0.71 per diluted share, for the full year of 2009 compared to $40.0 million, or $0.99, for the full year of 2008. For the fourth quarter of 2009, the Company reported a net loss of $2.8 million, or $0.07 per diluted share, compared to net income of $7.2 million, or $0.18 per diluted share, in the fourth quarter of 2008.

Full-Year 2009 Results

For the full year of 2009, the Company’s net income was $28.8 million, or $0.71 per diluted share, compared to $40.0 million, or $0.99, for the full year of 2008. The Company’s operating results in 2009 were adversely affected by broader conditions in the Florida residential insurance market. Florida authorities expanded the reimbursement coverage available from the Florida Hurricane Catastrophe Fund in 2007 causing residential insurers in Florida to reduce rates and also increased then-existing discounts available for homes built with certain windstorm loss reduction devices. The Company believes these cumulative actions resulted in premium reductions that were greater than the estimated reductions in losses and contributed to the decline in net income in 2009.

Also contributing to the decline in net income were Universal Property & Casualty Insurance Company’s (UPCIC’s) higher reinsurance costs in 2009 and a Florida Insurance Guaranty Association (FIGA) mandatory assessment of $4.1 million recorded in the fourth quarter of 2009. The mandatory assessment will be recovered through a surcharge on UPCIC’s policies, as approved by the Florida Office of Insurance Regulation in January 2010, and the Company expects it will have a positive effect on operating results over a twelve-month period beginning March 1, 2010.

The Company’s decline in net income was partially offset by realized gains on investments and foreign currency gains on investments. The Company’s investment portfolio generated $24.2 million in realized gains on investments and $6.8 million in foreign currency gains on investments for the full year of 2009. As of December 31, 2009, the Company’s investment portfolio contained $0.9 million of pre-tax net unrealized gains.

Stockholders’ equity increased 11.5 percent at December 31, 2009, compared to December 31, 2008, strengthening the Company’s balance sheet and allowing the Company to declare an aggregate of 54 cents per share in cash dividends in 2009, including a year-end cash dividend of 20 cents per share. The Company expects to continue to declare cash dividends in 2010, subject to future cash flow generation, profitability, balance sheet strength, and claim activity.

UPCIC’s recent premium rate increases, approved by the Florida Office of Insurance Regulation (Florida OIR), began to flow through UPCIC’s book of business during the 2009 fourth quarter, and the Company expects the rate increases to positively affect UPCIC’s premiums and profitability on a greater level as 2010 progresses. In an effort to further alleviate pressure on the Company’s operating results as described above, UPCIC intends to apply to the Florida OIR for future premium rate increases. However, there is no assurance that UPCIC will be successful in such efforts.

Policy count continues to improve at UPCIC as it added 80,000 polices during the full year of 2009, including 5,000 policies during the fourth quarter of 2009. In South Carolina, North Carolina, and Hawaii, UPCIC added an aggregate of 4,100 policies during the full year of 2009 including 1,200 policies during the fourth quarter of 2009. UPCIC intends to continue growth in these new markets as it expands relationships with independent agents.

Fourth-Quarter 2009 Results

The Company had a net loss of $2.8 million, or $0.07 per diluted share, compared to net income of $7.2 million, or $0.18 per diluted share, in the fourth quarter of 2008. Contributing to the decline was the $4.1 million FIGA assessment described above, and an increase in the volume of wind mitigation discounts, reduced premium rates, and higher reinsurance costs during the 2009 fourth quarter period as compared to the prior year fourth quarter. UPCIC also booked an additional $2.5 million of net loss and loss adjustment expense (LAE) reserves in order to strengthen reserves during the 2009 fourth quarter. The net loss in the fourth quarter of 2009 was partially offset by $10.6 million of pre-tax realized gains on investments and $0.7 million of pre-tax foreign currency gains on investments during the 2009 fourth quarter, compared to no realized gains on investments or foreign currency gains on investments during the 2008 fourth quarter.

UPCIC experienced continued growth in its policy count, servicing approximately 541,000 homeowners’ and dwelling fire insurance policies as of December 31, 2009, up from 536,000 policies and 461,000 policies at September 30, 2009, and December 31, 2008, respectively. The increase in the number of policies in-force continues to be the result of heightened relationships with existing agents, an increase in the number of new agents, and continued expansion opportunities that exist within the Florida marketplace. UPCIC also continues to be in the early phases of writing homeowners’ insurance policies in South Carolina, North Carolina, and Hawaii and as of December 31, 2009 had approximately 4,100 policies totaling approximately $5.9 million of in-force premiums in those states.

Premium rates decreased 4.1 percent statewide for homeowners’ policies and 0.2 percent statewide for dwelling fire policies as required by the Florida legislature in January 2008 for the homeowners’ program and March 2008 for the dwelling fire program. The effect of these rate decreases on existing policies and the corresponding premium decreases in direct written premium was fully recognized in UPCIC’s policies by early 2009. In February 2009, rate increases of 4.8 percent statewide for homeowners’ policies and 4.7 percent statewide for dwelling fire policies were approved by the Florida OIR and implemented in February 2009 for new business and April 2009 for renewal business. In October 2009, rate increases of 14.6 percent statewide for UPCIC’s homeowners’ program were approved by the Florida OIR and implemented in October 2009 for new business and in December 2009 for renewal business. Most recently, average rate increases of approximately 14.8 percent statewide for UPCIC’s dwelling fire policies were approved by the Florida OIR and were effective on November 5, 2009, for new business, and December 29, 2009, for renewal business. UPCIC expects these premium rate increases will improve profitability as they become more fully implemented across UPCIC’s book of business during 2010.

Realized gains on investments increased to $10.6 million for the three-month period ended December 31, 2009, from no realized gains on investments for the three-month period ended December 31, 2008. Foreign currency gains on investments increased to $0.7 million for the three-month period ended December 31, 2009, from no foreign currency gains on investments during the same period ended 2008. The increase in realized gains on investments and foreign currency gains on investments is the result of the expansion of the Company’s investment portfolio into fixed securities and equity securities and the related sales of certain of these securities.

In the fourth quarter of 2009, net losses and LAE increased 36.3 percent to $37.4 million from $27.5 million in the fourth quarter of 2008. While there was an absence of incurred net losses and LAE related to adverse weather events during the fourth quarter of 2009, the Company incurred an increase in net losses and LAE in connection with the servicing of additional policies. Additionally, during the 2009 fourth quarter, UPCIC booked an additional $2.5 million of net loss and LAE reserves above the independent actuary’s point reserve or best estimate in order to strengthen reserves.

Net premiums earned decreased 11.3 percent in the fourth quarter of 2009 compared to the same quarter in 2008, and the average premium per policy decreased significantly because of the wind mitigation credits and premium rate decreases. At December 31, 2009, UPCIC was servicing approximately 541,000 homeowners’ and dwelling fire insurance policies with in-force premiums of approximately $567.1 million, or an average of $1,048 per policy, compared to approximately 461,000 serviced and in-force premiums of approximately $518.2 million, or an average of $1,125 per policy at December 31, 2008. Consequently, as the result of increased net losses and LAE in connection with the servicing of additional policies, the net loss and LAE ratio increased significantly for the 2009 period. Additionally, total reinsurance costs were higher for the 2009 period compared to the 2008 period, which reduced net earned premium.

Fourth-quarter 2009 general and administrative expenses increased 258.9 percent to $21.6 million from $6.0 million in the 2008 fourth quarter. The FIGA mandatory assessment of $4.1 million accounted for approximately 26.3 percent of the increase in general and administrative expenses. The remainder of the increase in general and administrative expenses was attributable to several factors including lower ceding commissions, increased salaries for existing employees and higher employee count due to business growth.

At December 31, 2009, stockholders’ equity decreased to $113.3 million from $126.9 million at September 30, 2009, representing a decline of 10.7 percent, primarily a result of the Company’s net loss of $2.8 million during the quarter, a decrease of $4.0 million in unrealized gains on investments during the quarter, and payment of the year-end dividend of $7.5 million, or 20 cents per share. As of December 31, 2009, UPCIC’s statutory capital and surplus was $87.8 million versus $102.7 million at September 30, 2009. The decline in statutory capital at December 31, 2009, compared to September 30, 2009, is the result of an underwriting loss at UPCIC during the 2009 fourth quarter.

Cash Dividend

On January 19, 2010, Universal’s board of directors declared a cash dividend of $0.12 per share payable on April 6, 2010, to shareholders of record as of March 19, 2010.

Investment Portfolio Update

As of December 31, 2009, the Company’s investments in equity securities and fixed maturities totaled $114.8 million, compared to $89.4 million at September 30, 2009. At December 31, 2009, approximately 64.0 percent of the investments were in equity securities considered available for sale and 36.0 percent were in fixed maturities available for sale. As of December 31, 2009, the Company’s investment portfolio contained $0.9 million of pre-tax net unrealized gains.

UPCIC Expansion Plans

On March 5, 2010, Universal’s board of directors approved the Company’s plans for UPCIC to apply for expansion in five additional states including Maryland, Massachusetts, New Jersey, New York, and Virginia. There is no assurance that the Company will be successful in obtaining these licenses and no prediction of when, if licensed, the Company will commence operations in any of these states.

The expansion plans follow the Company’s efforts to further diversify and create additional growth opportunities reflective of UPCIC’s expansion in South Carolina, North Carolina, and Hawaii, where it currently writes property and casualty insurance, and into Georgia, where it is approved to write property and casualty insurance pending the approval of its rates and forms by the Georgia Department of Insurance.

About Universal Insurance Holdings, Inc.

Universal Insurance Holdings, Inc. (UIH) is a vertically integrated insurance holding company, which through its various subsidiaries, covers substantially all aspects of insurance underwriting, distribution, claims processing and exposure management. Universal Property & Casualty Insurance Company (UPCIC), a wholly owned subsidiary of UIH, is one of the five leading writers of homeowners’ insurance in Florida and is now fully licensed and has commenced its operations in Georgia, Hawaii, North Carolina and South Carolina. For additional information on the Company, please visit our investor relations Web site at www.universalinsuranceholdings.com

Readers should refer generally to reports filed by the Company with the Securities and Exchange Commission (SEC), specifically the Company’s Form 10-K for the year ended December 31, 2009, for a discussion of the risk factors that could affect its operations. Such factors include, without limitation, exposure to catastrophic losses; reliance on the Company’s reinsurance program; underwriting performance on catastrophe and non-catastrophe risks; the ability to maintain relationships with customers, employees or suppliers; competition and its effect on pricing, spending and third-party relationships; the Company’s financial stability rating; product pricing and revenues; and the effect of Federal or state laws and regulations. Additional factors that may affect future results are contained in the Company’s filings with the SEC, which are available on the SEC’s web site at https://www.sec.gov. The Company disclaims any obligation to update and revise statements contained in this press release based on new information or otherwise.

Cautionary Language Concerning Forward-Looking Statements

This press release contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. The words “believe,” “expect,” “anticipate,” and “project,” and similar expressions identify forward-looking statements, which speak only as of the date the statement was made. Such statements may include, but not be limited to, projections of revenues, income or loss, expenses, plans, and assumptions relating to the foregoing. Forward-looking statements are inherently subject to risks and uncertainties, some of which cannot be predicted or quantified. Future results could differ materially from those described in forward-looking statements.

Investor Contact:

Philip Kranz Dresner Corporate Services 312-780-7240 pkranz@dresnerco.com