Universal Insurance Holdings, Inc. Reports Second-Quarter 2009 Financial Results

UPCIC Policy Count Grows by Approximately 22,000 in the Second Quarter to Approximately 520,000 at June 30, 2009; Continued Profitability Leads to an 8.6 Percent Increase in Stockholders’ Equity at June 30, 2009, as Compared to March 31, 2009; Cash Dividends of 34 Cents Declared to Date in 2009

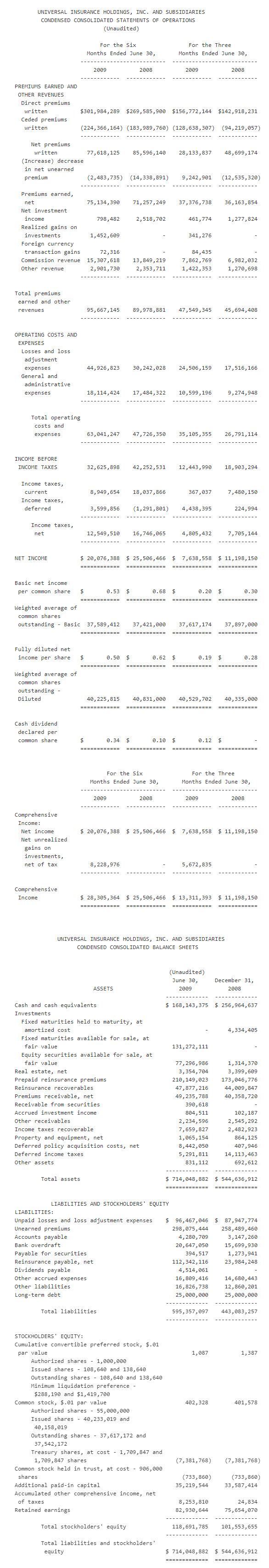

FORT LAUDERDALE, FL–(Marketwire – August 7, 2009) – Universal Insurance Holdings, Inc. (“the Company”) (NYSE Amex: UVE), a vertically integrated insurance holding company, announced second-quarter 2009 net income of $7.6 million, or $0.19 per diluted share, compared to $11.2 million, or $0.28 per diluted share, in the second quarter of 2008.

Management Comments

The Company commented, “During the 2009 second quarter, the Company continued to produce profitable results. As a result of the positive investment portfolio performance during the second quarter of 2009, the Company’s comprehensive income, which includes net unrealized gains on investments, net of tax, increased to $13.3 million for the 2009 second quarter compared to $11.2 million for the same period of 2008. Moreover, the Company’s balance sheet continued to strengthen, as stockholders’ equity increased 8.6 percent at June 30, 2009, as compared to March 31, 2009. The culmination of these achievements has afforded the Company the ability to declare 34 cents per share in dividends to date in 2009.

“In February 2009 the Florida Office of Insurance Regulation (Florida OIR) approved Universal Property & Casualty Insurance Company’s (UPCIC) premium rate increases of 4.8 percent statewide for homeowners’ policies and 4.7 percent statewide for dwelling fire policies, which have begun to flow through UPCIC’s book of business, and should continue to help mitigate increased operating expenses. Furthermore, on July 15, 2009, UPCIC submitted a filing to the Florida OIR for a proposed overall premium rate increase of 9.8 percent for its homeowners’ program to be effective October 15, 2009, for both new and renewal business. Also, on July 31, 2009, UPCIC submitted a filing to the Florida OIR for a proposed overall premium rate increase of 9.8 percent for its dwelling program to be effective November 15, 2009, for both new and renewal business. Both premium rate increases are subject to Florida OIR review and approval. To the extent that the premium rate increases are approved, we believe that they will benefit our results.

“UPCIC’s policy counts continue to show growth. UPCIC is in the early stages of writing policies in South Carolina, North Carolina, and Hawaii, and we look forward to further establishing UPCIC’s presence in these states. Also, additional state expansion opportunities exist as the Company’s subsidiaries have pending applications in Georgia and Texas. Finally, the continued disruption in the Florida insurance market, which was brought about as a result of previous hurricane activity and large insurers’ reduced business operations within the state, provides UPCIC with long-term opportunities for growth.”

Second Quarter Results

Notwithstanding an increase in the number of homeowners’ and dwelling fire insurance policies serviced by UPCIC and related growth in direct premiums written during the 2009 second quarter, the Company experienced a decrease in net income in the current period primarily as a result of the effects of state mandated rate reductions and wind mitigation discounts, increased non-catastrophe losses and loss adjustment expenses incurred, and decreased net premiums earned because of higher reinsurance costs in the 2009 period as compared to the 2008 period. However, the Company’s comprehensive income increased on a year-over-year basis in the 2009 second quarter as a result of positive investment portfolio performance, as net unrealized gains on investments totaled $5.7 million, net of tax, for the second quarter of 2009, while there were no net unrealized gains on investments for the same period of 2008.

UPCIC, the Company’s wholly-owned regulated insurance subsidiary, saw continued growth in its policy count, servicing approximately 520,000 homeowners’ and dwelling fire insurance policies as of June 30, 2009, up from 498,000 policies and 432,000 policies at March 31, 2009, and June 30, 2008, respectively. The increase in the number of policies in-force continues to be the result of heightened relationships with existing agents, an increase in the number of new agents, and the continued disruption in the Florida marketplace. Additionally, as previously announced, UPCIC recently started to write homeowners’ insurance policies in South Carolina, North Carolina, and Hawaii. As of June 30, 2009, the subsidiary has written approximately 1,068 policies totaling approximately $1.7 million of in-force premiums in those states.

In-force premiums were approximately $550.7 million as of June 30, 2009, versus $513.0 million at June 30, 2008, while direct premiums written were $156.8 million in the second quarter of 2009, compared to $142.9 million for the same period of 2008. In-force premiums at March 31, 2009, were approximately $534.3 million.

As the Company has previously discussed, a rate decrease required by the Florida legislature resulted in rate decreases averaging 11.1 percent statewide on UPCIC’s homeowners’ policies and 2.3 percent statewide on UPCIC’s dwelling fire policies, and were integrated into UPCIC’s rates on June 1, 2007. The effect of these rate decreases on existing policies and the corresponding premium decreases in direct written premiums was fully recognized in UPCIC’s policies by May 31, 2008. Also, rate decreases of 4.1 percent statewide for homeowners’ policies and 0.2 percent statewide for dwelling fire policies were required by the Florida legislature and implemented with effective dates in January 2008 for the homeowners’ program and March 2008 for the dwelling fire program. The effect of these rate decreases on existing policies and the corresponding premium decreases in direct written premium was fully recognized in UPCIC’s policies by January 2009 for the homeowners’ program and March 2009 for the dwelling fire program. However, in February 2009 rate increases of 4.8 percent statewide for homeowners’ policies and 4.7 percent statewide for dwelling fire policies were approved by the Florida OIR and were implemented with effective dates of February 27, 2009, for new business and April 19, 2009, for renewal business. Despite the most recent rate increases, the cumulative effect of the prior rate decreases had an adverse effect on UPCIC’s premium growth during the 2009 second quarter.

Additionally, UPCIC recognized a higher volume of premium discounts in response to a state-required wind mitigation discount program available to policyholders, which have had a continued significant negative effect on UPCIC’s premium volume and as a result significantly negatively impacted net income. As of June 30, 2008, 21.3 percent of UPCIC policyholders were receiving wind mitigation credits totaling $74.2 million, (a 12.7 percent reduction of in-force premium), while 40.4 percent of UPCIC policyholders were receiving wind mitigation credits totaling $188.1 million, (a 25.7 percent reduction of in-force premium), at June 30, 2009.

Nonetheless, net premiums earned increased 3.4 percent to $37.4 million in the second quarter of 2009, from $36.2 million in the 2008 second quarter, as a result of an increase in direct premiums earned (net of previously discussed rate decreases and implementation of higher wind mitigation credits).

Net investment income decreased 63.9 percent to $461,774 for the three-month period ended June 30, 2009, from $1.3 million for the same period of 2008. Net investment income is comprised primarily of interest and dividends. The decrease is primarily because of changes in the composition of the Company’s investment portfolio during the three-month period ended June 30, 2009.

Realized gains on investments increased to $341,276 for the three-month period ended June 30, 2009, from no realized gains on investments for the three-month period ended June 30, 2008. The increase is a result of the expansion of the Company’s investment portfolio into equity securities and the related sales of these securities.

The Company’s commission revenue increased 12.6 percent to $7.9 million in the 2009 second quarter, from $7.0 million in the same quarter last year. Commission revenue is comprised principally of the managing general agent’s policy fee income and service fee income on all new and renewal insurance policies, reinsurance commission sharing agreements, and commissions generated from agency operations. The increase is primarily attributable to an increase in reinsurance commission sharing of approximately $376,000, and an increase in the managing general agent’s policy fee income of approximately $510,000.

Other revenue increased 11.9 percent to $1.4 million in the 2009 second quarter, from $1.3 million in the 2008 period, primarily attributable to growth in fees earned on payment plans offered to policyholders by UPCIC.

In the second quarter of 2009, net losses and loss adjustment expenses (LAE) increased 39.9 percent to $24.5 million from $17.5 million in the second quarter of 2008. The net loss ratio, which is derived from net losses and LAE as a percentage of net earned premium, for the three-month period ended June 30, 2009, was 65.6 percent compared to 48.4 percent for the same period of 2008. The increase in the net loss ratio is primarily attributable to the increase in direct loss and LAE incurred outpacing the increase in direct earned premium in the 2009 quarter as compared to the 2008 quarter.

Although total direct premiums earned increased 7.5 percent in the 2009 second quarter compared to the same quarter in 2008, the average premium per policy decreased significantly because of the previously described rate decreases and wind mitigation credits. At June 30, 2009, UPCIC was servicing approximately 520,000 homeowners’ and dwelling fire insurance policies with in-force premiums of approximately $550.7 million, or an average of $1,059 per policy, while the amount of policies UPCIC was servicing at June 30, 2008 was approximately 432,000 with in-force premiums of approximately $513.0 million, or an average of $1,188. Consequently, as a result of increased net losses and LAE in connection with the servicing of additional policies, the direct loss and LAE ratio increased significantly for the 2009 period. Additionally, total reinsurance costs are higher for the 2009 period as compared to the 2008 period, which reduced net earned premium.

Second-quarter 2009 general and administrative expenses increased 14.3 percent to $10.6 million from $9.3 million in the 2008 second quarter. The increase in general and administrative expenses was due to several factors including increased salaries for existing employees and higher employee count due to business growth. Also, ceded commissions decreased as a result of the quota share reinsurance commission rate reduction to 25 percent for the 2009-2010 contract year from 31 percent for the 2008-2009 contract year. Deferred policy acquisition costs were also affected by this reduction.

At June 30, 2009, stockholders’ equity increased to $118.7 million from $109.3 million at March 31, 2009, representing growth of 8.6 percent. As of June 30, 2009, UPCIC’s statutory capital and surplus was $103.1 million versus $98.5 million at March 31, 2009.

Investment Portfolio Update

The Company’s investment portfolio includes a greater level of fixed maturities and equity securities at June 30, 2009, as compared to December 31, 2008, and earlier periods in order to more conservatively limit its exposure to the volatility in the current banking environment. Approximately 62.9 percent of the investments were in fixed maturities available for sale and 37.1 percent in equity securities considered available for sale, based upon the Company’s estimates of required liquidity. Furthermore, the equity security position continues to be comprised of holdings in natural resources sectors including energy, metals, and agriculture. At this time, the Company does not participate in swaps, options, futures or forward contracts to hedge or enhance the investment portfolio, however, in the future the Company may use options contracts to hedge unrealized gains.

For the three-month period ended June 30, 2009, the Company had net unrealized gains on investments, net of tax, of $5.7 million, as compared to no net unrealized gains on investments, net of tax, as of June 30, 2008.

About Universal Insurance Holdings, Inc.

Universal Insurance Holdings, Inc. (UIH) is a vertically integrated insurance holding company, which through its various subsidiaries, covers substantially all aspects of insurance underwriting, distribution, claims processing and exposure management. Universal Property & Casualty Insurance Company (UPCIC), a wholly owned subsidiary of UIH, is one of the five leading writers of homeowners’ insurance in Florida and is now fully licensed and has commenced its operations in Georgia, Hawaii, North Carolina and South Carolina. Additionally, the Company has filed an application to the Texas Department of Insurance to form a separate property and casualty subsidiary to write homeowners’ insurance coverage in Texas. For additional information on the Company, please visit our investor relations Web site at www.universalinsuranceholdings.com

Readers should refer generally to reports filed by the Company with the Securities and Exchange Commission (SEC), specifically the Company’s Form 10-K for the year ended December 31, 2008, and the Company’s Form 10-Q for the quarterly period ended June 30, 2009, for a discussion of the risk factors that could affect its operations. Such factors include, without limitation, exposure to catastrophic losses; reliance on the Company’s reinsurance program; underwriting performance on catastrophe and non-catastrophe risks; the ability to maintain relationships with customers, employees or suppliers; competition and its effect on pricing, spending and third-party relationships; the Company’s financial stability rating; product pricing and revenues; and the effect of Federal or state laws and regulations. Additional factors that may affect future results are contained in the Company’s filings with the SEC, which are available on the SEC’s web site at https://www.sec.gov. The Company disclaims any obligation to update and revise statements contained in this press release based on new information or otherwise.

Cautionary Language Concerning Forward-Looking Statements

This press release contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. The words “believe,” “expect,” “anticipate,” and “project,” and similar expressions identify forward-looking statements, which speak only as of the date the statement was made. Such statements may include, but not be limited to, projections of revenues, income or loss, expenses, plans, and assumptions relating to the foregoing. Forward-looking statements are inherently subject to risks and uncertainties, some of which cannot be predicted or quantified. Future results could differ materially from those described in forward-looking statements.

Investor Contact: Philip Kranz Dresner Corporate Services 312-780-7240 Email Contact