Universal Insurance Holdings, Inc. Reports Second Quarter 2017 Financial Results

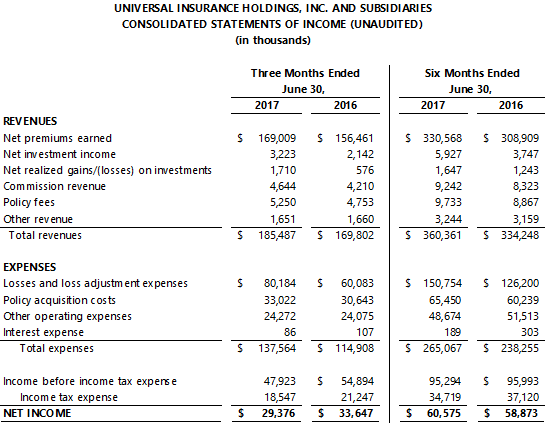

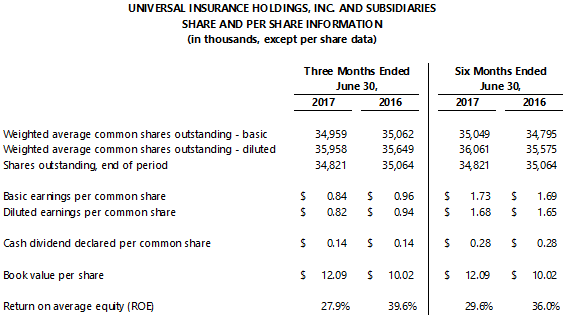

Fort Lauderdale, FL, July 31, 2017 – Universal Insurance Holdings, Inc. (NYSE: UVE) today reported net income and diluted earnings per share (EPS) of $29.4 million and $0.82, respectively for the second quarter of 2017. For the first six months of 2017, net income was $60.6 million while diluted EPS was $1.68.

Universal Insurance Holdings, Inc. Chairman and Chief Executive Officer Sean P. Downes commented: “Universal reported excellent top line growth during the second quarter, as well as substantial underwriting profit despite an increased volume of severe weather events during the period. Although our bottom line results for the quarter were modestly impacted by these events, we still delivered a 27.9% return on average equity for the second quarter, which is a testament to the fundamental strength of our business model. Universal remains well positioned on all fronts to deliver outstanding value to our shareholders going forward, with a focus on producing profitable and rate-adequate organic growth within Florida and through our Other State expansion efforts, further enhancing our unique direct-to-consumer platform, Universal Direct℠, and continuing to leverage our vertically integrated structure to deliver better service to our policyholders.”

Second Quarter 2017 Highlights

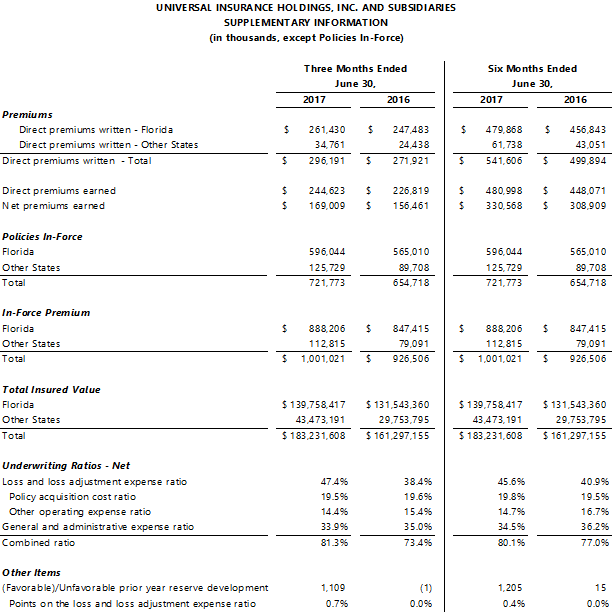

- Growth Continues as $1 Billion of In-Force Premium Milestone Reached – Direct premiums written grew 8.9% during the second quarter, including 5.6% growth in Florida and 42.2% growth in Other States, with Universal Direct℠ contributing to growth across all geographies. At quarter’s end our in-force premium was in excess of $1 billion for the first time in the Company’s history. During the quarter, we wrote our first homeowners policy and launched Universal Direct℠ in New Jersey, and received approval from the New York Department of Financial Services for our homeowners rates and forms (we anticipate writing policies in New York later in 2017). Universal is currently writing business in 15 states and is licensed in an additional 4 states.

- Underwriting Profitability Strong Despite Weather – The net combined ratio was 81.3% in the second quarter, up from 73.4% in the prior year’s quarter due to an increase in the loss and LAE ratio, partially offset by a reduction in the G&A expense ratio. Current quarter results include a 1.25% increase to our underlying direct loss ratio to increase our weather loss expectation, as well as $1.1 million of reserve additions relating to Hurricane Matthew.

- 2Q Bottom Line Declines, but Year-to-Date Results Excellent – Second quarter net income and diluted EPS each declined by roughly 13%, to $29.4 million and $0.82 per share, respectively, primarily driven by an increase in weather-related losses. For the first six months of 2017, net income grew by 2.9% to $60.6 million and diluted EPS grew 1.5% to $1.68 per share.

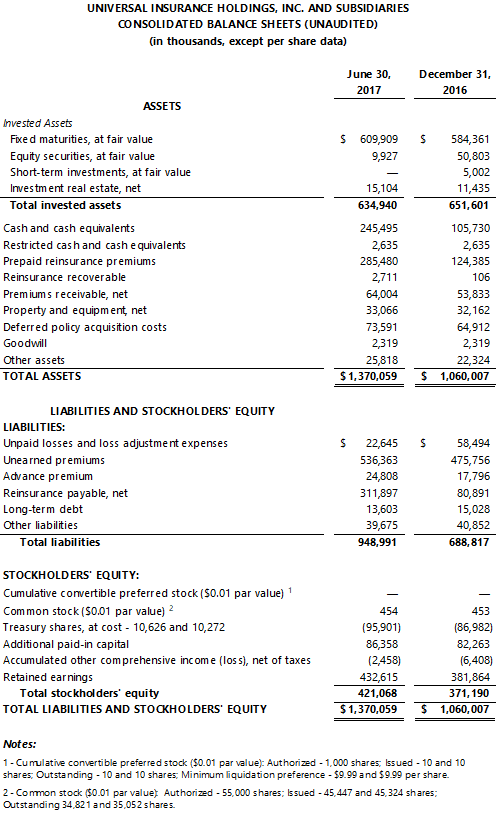

- Balance Sheet Remains Solid – Book value per share grew by 6.4% from March 31, 2017 (or 20.7% from June 30, 2016) to $12.09. Our balance sheet remains solid, with a stable investment portfolio, minimal debt, and a conservative reserve position. Our balance sheet is well protected by reinsurance, and we completed our 2017-2018 reinsurance program during the second quarter, adding additional conservatism to the program without increasing the percentage of premium spent on reinsurance.

- Focused on Shareholder Returns – Return on Average Common Equity (ROE) was 27.9% for the second quarter of 2017. We declared dividends of $0.14 per share in the second quarter, equating to an annualized dividend yield of 2.4% at current share price levels. During the second quarter, we repurchased 254,214 shares for $6.4 million, or an average cost of $25.06 per share.

Second Quarter 2017 Results

Direct premiums written grew 8.9% from the prior year’s quarter to $296.2 million, with 5.6% growth in our Florida book and 42.2% growth in our Other States book. Our organic growth strategy within our home state of Florida remains on track, and our organic geographic expansion efforts within our Other States book continue to produce results. For the quarter, net premiums earned grew 8.0% to $169.0 million. Commission revenue and policy fees each produced double-digit growth, up 10.3% and 10.5% versus the prior year’s quarter, respectively, driven by increased premium volume and continued geographic footprint expansion, while other revenue was flat with the prior year’s quarter.

The net combined ratio was 81.3% in the second quarter of 2017 compared to 73.4% in the prior year’s quarter. The reduction in underwriting profitability was driven by an increase in the loss and loss adjustment expense ratio, partially offset by a reduction in the general and administrative expense ratio.

- The net loss and LAE ratio was 47.4% in the second quarter of 2017, compared to 38.4% for the prior year’s quarter. The increase in the current quarter’s loss and LAE ratio was driven by an increased underlying loss ratio reflecting the recent trend of weather losses, continued growth in our Other States book, current marketplace dynamics, and prior accident year reserve development. In light of the recent trend of weather losses exceeding our planned assumption, we are increasing our underlying direct loss ratio by 1.25 points (1.8 points on the net loss ratio, or approximately $3.0 million of additional losses per quarter) to increase our weather loss expectation going forward. The current quarter includes this adjustment for our 2017 year-to-date results, reflecting an adjustment to the underlying loss ratio for both the first and second quarter of 2017, for an addition to second quarter 2017 losses of approximately $6 million or 3.6 points on the net loss and LAE ratio. Second quarter 2017 results also include prior year reserve additions of $1.1 million, driven by additional losses relating to Hurricane Matthew, while last year’s second quarter included a negligible amount of prior year reserve development. Importantly, Hurricane Matthew losses still remain within the initial range discussed on our third quarter 2016 earnings conference call.

- The net general and administrative expense ratio was 33.9% in the second quarter of 2017, compared to 35.0% for the same period last year, driven primarily by a reduction in the other operating expense ratio, with a slight reduction in the policy acquisition cost ratio. The net other operating expense ratio was 14.4% compared to 15.4% in the prior year’s quarter, while the net policy acquisition cost ratio was 19.5% compared to 19.6% in the prior year’s quarter.

Net investment income grew by 50.5% from the prior year’s quarter to $3.2 million, driven by the increasing size of our investment portfolio, a shift in asset mix, and a reduction in our investment expenses. Net realized investment gains were $1.7 million in the second quarter of 2017, compared to net realized gains of $576 thousand in the prior year’s quarter. Total unrestricted cash and invested assets grew to $880.4 million at June 30, 2017 from $826.4 million at March 31, 2017 and $841.7 million at June 30, 2016.

Interest expense was $86 thousand for the second quarter of 2017, down from $106 thousand in the prior year’s quarter, as we continue to reduce our level of outstanding debt. Long term debt was $13.6 million as of June 30, 2017 (debt-to-equity of 3.2%), down from $14.0 million at March 31, 2017 (debt-to-equity of 3.5%) and $15.8 million as of June 30, 2016 (debt-to-equity of 4.5%).

The effective tax rate for the second quarter of 2017 was 38.7%, in-line with 38.7% in the prior year’s quarter.

During the second quarter, the Company repurchased 254,214 shares for $6.4 million, or an average cost of $25.06 per share. $9.0 million remains on our current repurchase authorization.

Stockholders’ equity was $421.1 million at June 30, 2017, growth of 5.6% from March 31, 2017 and 19.8% from June 30, 2016. Book value per common was $12.09 at June 30, 2017, growth of 6.4% from $11.37 at March 31, 2017 or 20.7% from $10.02 at June 30, 2016. Return on Average Common Equity (ROE) was 27.9% for the second quarter of 2017.

On April 12, 2017, the Company announced that its Board of Directors declared a cash dividend of $0.14 per share of common stock paid on July 3, 2017 to shareholders of record on June 14, 2017.

Conference Call

Members of the Universal management team will host a conference call on Tuesday, August 1, 2017 at 10:00 AM ET to discuss second quarter 2017 financial results. Following prepared remarks, management will conduct a question and answer session. The call will be accessible by dialing toll free at (888) 887-7180 or internationally (toll) at (270) 823-1518 using the Conference ID: 57183559. A live audio webcast of the call will also be accessible on the Universal Insurance website at www.universalinsuranceholdings.com. A replay of the call can be accessed toll free at (855) 859-2056 or internationally (toll) at (404) 537-3406 using the Conference ID: 57183559, and will be available through August 16, 2017.

About Universal Insurance Holdings, Inc.

Universal Insurance Holdings, Inc., with its wholly-owned subsidiaries, is a vertically integrated insurance holding company performing all aspects of insurance underwriting, distribution and claims. Universal Property & Casualty Insurance Company (UPCIC), a wholly-owned subsidiary of the Company, is one of the leading writers of homeowners insurance in Florida and is now fully licensed and has commenced its operations in North Carolina, South Carolina, Hawaii, Georgia, Massachusetts, Maryland, Delaware, Indiana, Pennsylvania, Minnesota, Michigan, Alabama, Virginia, and New Jersey. American Platinum Property and Casualty Insurance Company (APPCIC), also a wholly-owned subsidiary, currently writes homeowners multi-peril insurance on Florida homes valued in excess of $1 million, which are limits and coverages currently not targeted through its affiliate UPCIC. APPCIC is additionally licensed and has commenced writing Fire, Commercial Multi-Peril, and Other Liability lines of business in Florida. For additional information on the Company, please visit our investor relations website at www.universalinsuranceholdings.com.

Forward-Looking Statements and Risk Factors

This press release may contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. The words “believe,” “expect,” “anticipate,” and similar expressions identify forward-looking statements, which speak only as of the date the statement was made. Such statements may include commentary on plans, products and lines of business, marketing arrangements, reinsurance programs and other business developments and assumptions relating to the foregoing. Forward-looking statements are inherently subject to risks and uncertainties, some of which cannot be predicted or quantified. Future results could differ materially from those described, and the Company undertakes no obligation to correct or update any forward-looking statements. For further information regarding risk factors that could affect the Company’s operations and future results, refer to the Company’s reports filed with the Securities and Exchange Commission, including Form 10-K for the year ended December 31, 2016 and Form 10-Q for the quarter ended March 31, 2017.

Contacts:

Investors

Dean Evans

VP Investor Relations

954-958-1306

de0130@universalproperty.com

Media

Andy Brimmer / Mahmoud Siddig

Joele Frank, Wilkinson Brimmer Katcher

212-355-4449