Universal Insurance Holdings, Inc. Reports Third Quarter 2017 Financial Results

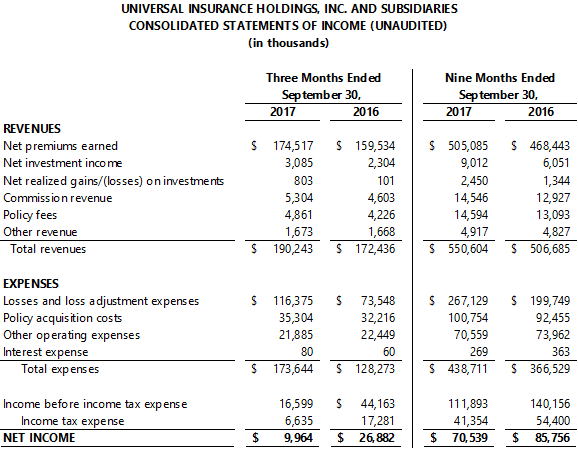

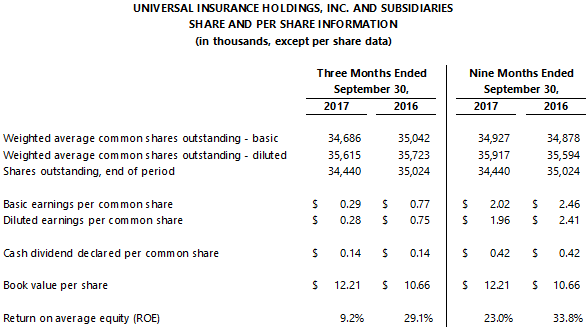

Fort Lauderdale, FL, November 8, 2017 – Universal Insurance Holdings, Inc. (NYSE: UVE) today reported net income and diluted earnings per share (EPS) of $10.0 million and $0.28, respectively for the third quarter of 2017. For the first nine months of 2017, net income was $70.5 million while diluted EPS was $1.96.

Universal Insurance Holdings, Inc. Chairman and Chief Executive Officer Sean P. Downes commented: “While our bottom line results for the third quarter were materially impacted by Hurricane Irma, we still delivered a 9.2% return on average equity for the third quarter and a 23.0% ROE for the first nine months of 2017. These results are a testament to the fundamental strength of our business model, including the benefits of our vertically integrated structure, our conservative reinsurance program, our focus on maintaining high underwriting standards, our superior claims handling abilities, and our exceptional catastrophe response team. We reported excellent top line growth during the third quarter, and continue to focus on producing profitable and rate-adequate organic growth within Florida and through our Other State expansion, while growing our unique direct-to-consumer platform, Universal DirectSM, and leveraging our vertically integrated structure to deliver better service to our policyholders. Universal weathered the storm that was Hurricane Irma well in the third quarter, and we remain well positioned to deliver outstanding value to our shareholders going forward.”

Third Quarter 2017 Highlights

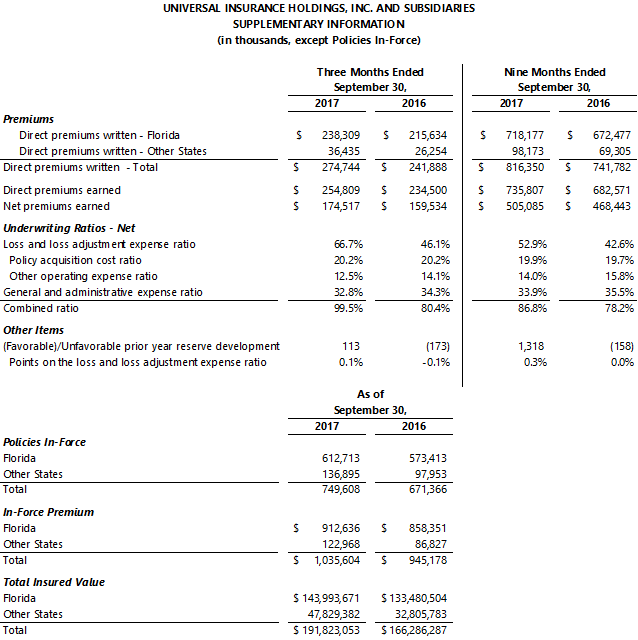

- Growth Continues Both Within and Outside Florida – Direct premiums written grew 13.6% during the third quarter, with 10.5% growth in Florida and 38.8% growth in Other States, and Universal DirectSM contributing to growth across all geographies. In October, we wrote our first homeowners policy in New York; Universal currently writes in 16 states with licenses in another 3 states.

- Hurricane Irma Leads to Modest Underwriting Gain – The third quarter net combined ratio was 99.5%, up from 80.4% in the prior year’s quarter due to an increase in the loss and LAE ratio, partially offset by a reduction in the G&A expense ratio. Current quarter results include $37 million (21.2 points) of Hurricane Irma losses and LAE, compared to $11 million (6.9 points) of weather losses above plan in third quarter 2016.

- In Challenging Quarter, Universal Produces 3Q Net Income – Despite meaningful losses from Hurricane Irma, our conservative reinsurance program and vertically integrated structure enabled Universal to produce net income for the quarter of $10.0 million or $0.28 per share of diluted EPS. For the first nine months of 2017, net income was $70.5 million and diluted EPS was $1.96 per share.

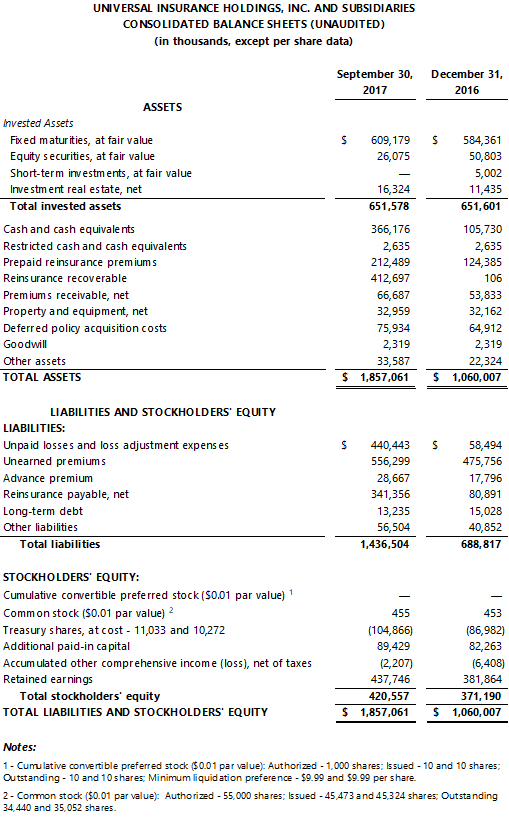

- Balance Sheet Remains Solid – Book value per share grew by 1.0% from June 30, 2017 (or 14.6% from September 30, 2016) to $12.21. Our balance sheet remains solid, with a stable investment portfolio, minimal debt, and a conservative reserve position, and is well protected by a comprehensive reinsurance program placed with strong reinsurance partners that helped to limit the overall financial impact of the devastating catastrophic events that took place during the third quarter.

- Focused on Shareholder Returns – Return on Average Common Equity (ROE) was 9.2% for the third quarter of 2017 and 23.0% through the first nine months of 2017. We declared dividends of $0.14 per share in the third quarter, equating to an annualized dividend yield of 2.4% at current share price levels. Universal repurchased 406,266 shares for $9.0 million ($22.07 per share) during the quarter, nearly exhausting our prior repurchase authorization, and the Board subsequently approved a new $20 million program.

Third Quarter 2017 Results

Direct premiums written grew 13.6% from the prior year’s quarter to $274.7 million, with 10.5% growth in our Florida book and 38.8% growth in our Other States book. Our organic growth strategy within our home state of Florida remains on track, and our organic geographic expansion efforts within our Other States book continue to produce results. Additionally, we note that third quarter 2017 results include an increased level of both new and renewal business within our Florida book surrounding Hurricane Irma. For the quarter, net premiums earned grew 9.4% to $174.5 million. Commission revenue and policy fees each produced double-digit growth, up 15.2% and 15.0% versus the prior year’s quarter, respectively, driven by increased premium volume and continued geographic footprint expansion, while other revenue was flat with the prior year’s quarter.

The net combined ratio was 99.5% in the third quarter of 2017 compared to 80.4% in the prior year’s quarter. The reduction in underwriting profitability was driven by an increase in the loss and loss adjustment expense ratio, partially offset by a reduction in the general and administrative expense ratio.

- The net loss and LAE ratio was 66.7% in the third quarter of 2017, compared to 46.1% for the prior year’s quarter. The increase in the current quarter’s loss and LAE ratio was primarily driven by loss and loss adjustment expenses of $37 million (21.2 points on the loss and LAE ratio) relating to Hurricane Irma, compared to $11 million (6.9 points) of weather losses beyond plan in the third quarter of 2016. Additionally, the current year’s quarter also included an increased underlying loss ratio reflecting continued growth in our Other States book and current marketplace dynamics. Third quarter 2017 results include $0.1 million (0.1 points) of unfavorable prior year reserve development, while 2016’s third quarter included $0.2 million (0.1 points) of favorable prior year reserve development.

- The net general and administrative expense ratio was 32.8% in the third quarter of 2017, compared to 34.3% for the same period last year, driven primarily by a reduction in the other operating expense ratio, while the policy acquisition cost ratio remained flat with the prior year’s quarter. The net other operating expense ratio was 12.5% compared to 14.1% in the prior year’s quarter, while the net policy acquisition cost ratio was 20.2% compared to 20.2% in the prior year’s quarter.

Net investment income grew by 33.9% from the prior year’s quarter to $3.1 million, driven by the increasing size of our investment portfolio and a shift in asset mix. Net realized investment gains were $0.8 million in the third quarter of 2017, compared to net realized gains of $0.1 million in the prior year’s quarter. Total unrestricted cash and invested assets grew to $1,017.8 million at September 30, 2017 from $880.4 million at June 30, 2017 and $849.1 million at September 30, 2016. Unrestricted cash and cash equivalents as of September 30, 2017 increased by $120.7 million compared to June 30, 2017, primarily related to payments received from reinsurers for claims related to Hurricane Irma.

Interest expense was $80 thousand for the third quarter of 2017, compared to $60 thousand in the prior year’s quarter, with long term debt of $13.2 million at September 30, 2017 (debt-to-equity of 3.1%), compared to $15.4 million as of September 30, 2016 (debt-to-equity of 4.1%).

The effective tax rate for the third quarter of 2017 was 40.0%, compared to 39.1% in the prior year’s quarter.

Stockholders’ equity was $420.6 million at September 30, 2017, down 0.1% from June 30, 2017, but up 12.7% from September 30, 2016. Book value per common was $12.21 at September 30, 2017, growth of 1.0% from $12.09 at June 30, 2017, or 14.6% from $10.66 at September 30, 2016. Return on Average Common Equity (ROE) was 9.2% for the third quarter of 2017 and 23.0% for the first nine months of 2017.

During the third quarter, the Company repurchased 406,266 shares for $9.0 million, or an average cost of $22.07 per share, nearly exhausting our prior share repurchase authorization. The Board of Directors has approved a new share repurchase program under which the Company may repurchase up to $20 million of its outstanding shares of common stock through December 31, 2018.

On August 31, 2017, the Company announced that its Board of Directors declared a cash dividend of $0.14 per share of common stock paid on October 24, 2017 to shareholders of record on September 12, 2017.

Conference Call

Members of the Universal management team will host a conference call on Thursday, November 9, 2017 at 10:00 AM ET to discuss third quarter 2017 financial results. Following prepared remarks, management will conduct a question and answer session. The call will be accessible by dialing toll free at (888) 887-7180 or internationally (toll) at (270) 823-1518 using the Conference ID: 8188499. A live audio webcast of the call will also be accessible on the Universal Insurance website at www.universalinsuranceholdings.com. A replay of the call can be accessed toll free at (855) 859-2056 or internationally (toll) at (404) 537-3406 using the Conference ID: 8188499, and will be available through November 24, 2017.

About Universal Insurance Holdings, Inc.

Universal Insurance Holdings, Inc., with its wholly-owned subsidiaries, is a vertically integrated insurance holding company performing all aspects of insurance underwriting, distribution and claims. Universal Property & Casualty Insurance Company (UPCIC), a wholly-owned subsidiary of the Company, is one of the leading writers of homeowners insurance in Florida and is now fully licensed and has commenced its operations in North Carolina, South Carolina, Hawaii, Georgia, Massachusetts, Maryland, Delaware, Indiana, Pennsylvania, Minnesota, Michigan, Alabama, Virginia, New Jersey, and New York. American Platinum Property and Casualty Insurance Company (APPCIC), also a wholly-owned subsidiary, currently writes homeowners multi-peril insurance on Florida homes valued in excess of $1 million, which are limits and coverages currently not targeted through its affiliate UPCIC. APPCIC is additionally licensed and has commenced writing Fire, Commercial Multi-Peril, and Other Liability lines of business in Florida. For additional information on the Company, please visit our investor relations website at www.universalinsuranceholdings.com.

Forward-Looking Statements and Risk Factors

This press release may contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. The words “believe,” “expect,” “anticipate,” and similar expressions identify forward-looking statements, which speak only as of the date the statement was made. Such statements may include commentary on plans, products and lines of business, marketing arrangements, reinsurance programs and other business developments and assumptions relating to the foregoing. Forward-looking statements are inherently subject to risks and uncertainties, some of which cannot be predicted or quantified. Future results could differ materially from those described, and the Company undertakes no obligation to correct or update any forward-looking statements. For further information regarding risk factors that could affect the Company’s operations and future results, refer to the Company’s reports filed with the Securities and Exchange Commission, including Form 10-K for the year ended December 31, 2016 and Form 10-Q for the quarter ended June 30, 2017.

Contacts

Investors

Dean Evans

VP Investor Relations

954-958-1306

de0130@universalproperty.com

Media

Andy Brimmer / Mahmoud Siddig

Joele Frank, Wilkinson Brimmer Katcher

212-355-4449