Universal Insurance Holdings Reports Third Quarter 2019 Results

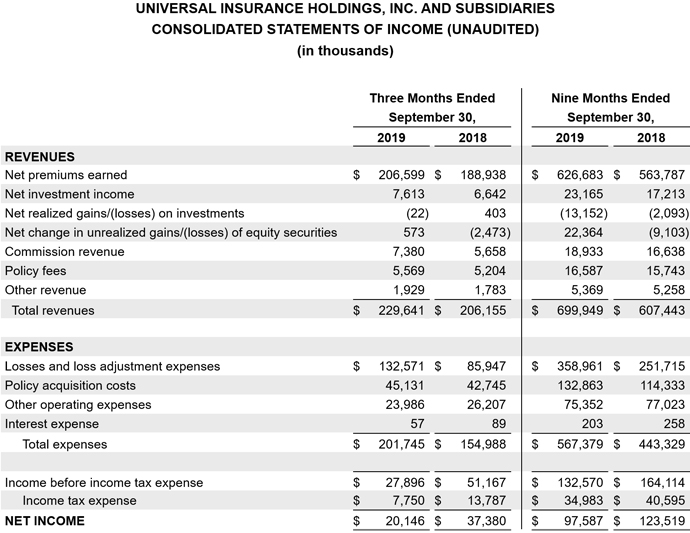

- 3Q19 total revenue up 11.4% to $229.6 million; YTD19 up 15.2% to $699.9 million

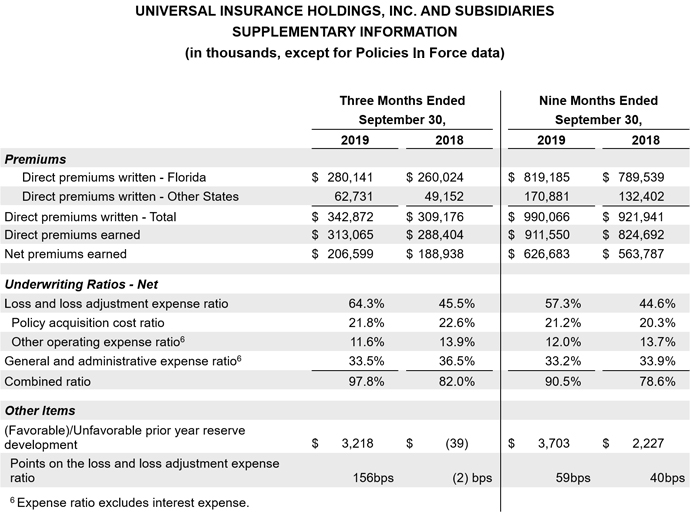

- 3Q19 direct premiums written (“DPW”) up 10.9% to $342.9 million; YTD19 up 7.4% to $990.1 million

- 3Q19 other states (non-Florida) DPW up 27.6%; YTD19 up 29.1%

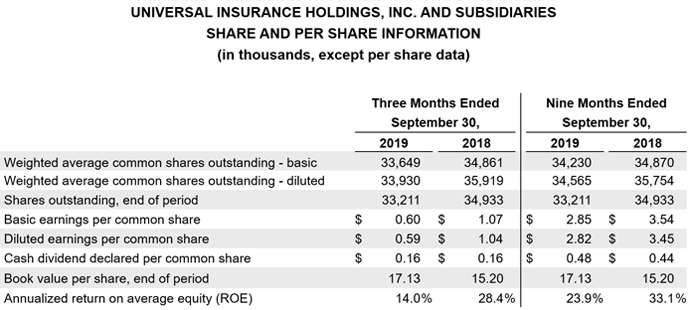

- 3Q19 diluted GAAP earnings per share (“EPS”) of $0.59, non-GAAP adjusted EPS1 of $0.61

- Year-over-year book value per share up 12.7% to $17.13

- YTD19 diluted GAAP EPS of $2.82, non-GAAP adjusted EPS1 of $2.67

- YTD19 combined ratio of 90.5%

- YTD19 annualized return on average equity of 23.9%

- YTD19 Returned a record $49.9 million to shareholders through opportunistic share repurchases

(1) Excludes net realized and unrealized gains and losses on investments as well as extraordinary reinstatement premiums and associated commissions (“non-GAAP adjusted EPS”). Reconciliations of GAAP to non-GAAP financial measures are provided in the attached tables.

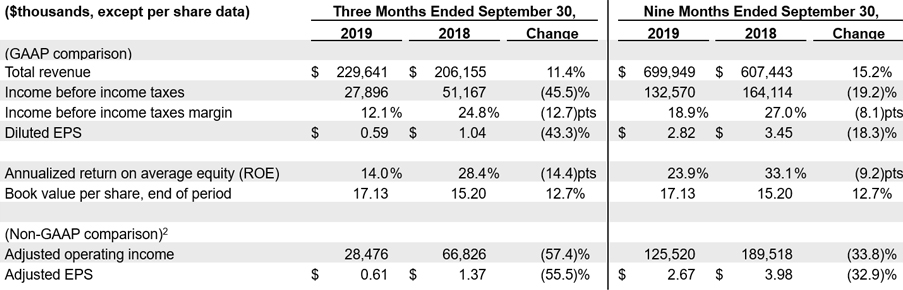

Fort Lauderdale, Fla., October 30, 2019 – Universal Insurance Holdings (NYSE: UVE) (the “Company”) reported 2019 third quarter diluted EPS of $0.59 on a GAAP basis and $0.61 non-GAAP adjusted EPS.1 Total revenue was up 11.4% from the year-ago quarter to $229.6 million. Book value per share grew to $17.13, an increase of 12.7% year-over-year, with a year-to-date annualized return on average equity of 23.9%.

“We achieved double digit revenue growth for both the third quarter and year-to-date periods, with solid profitability, resulting in a strong year-to-date total annualized return on average equity of 23.9%,” said Stephen J. Donaghy, Chief Executive Officer. “We believe these results, combined with the outstanding work our claims servicing team has done in bringing closure to prior years catastrophe events, and the launch this quarter of our multi-rater quote-to-bind platform on CloveredSM, where consumers can now receive up to five side-by-side quotes online from different carriers, positions us well to continue to deliver on our strategic priorities.”

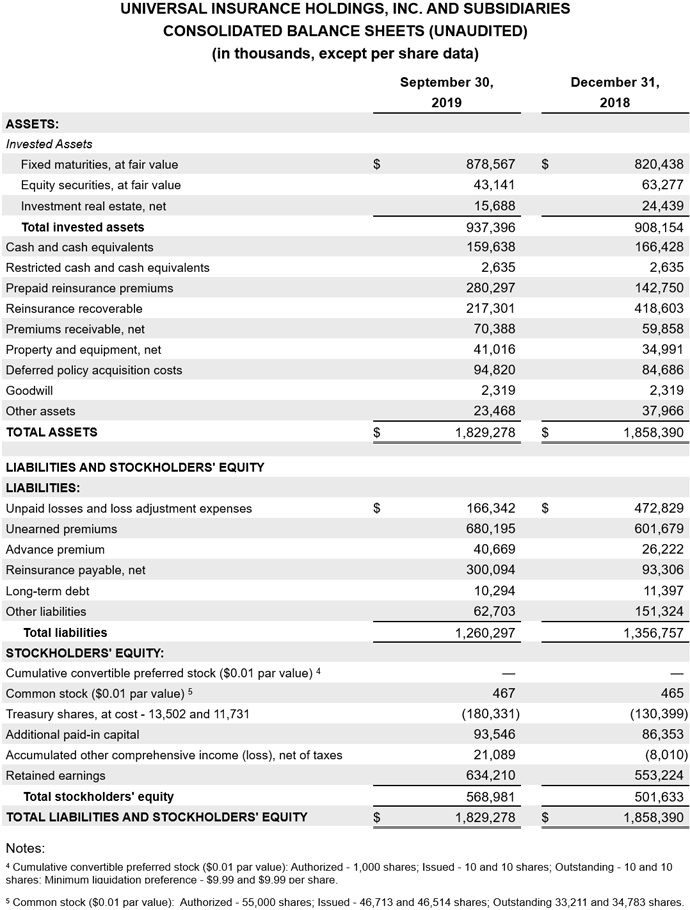

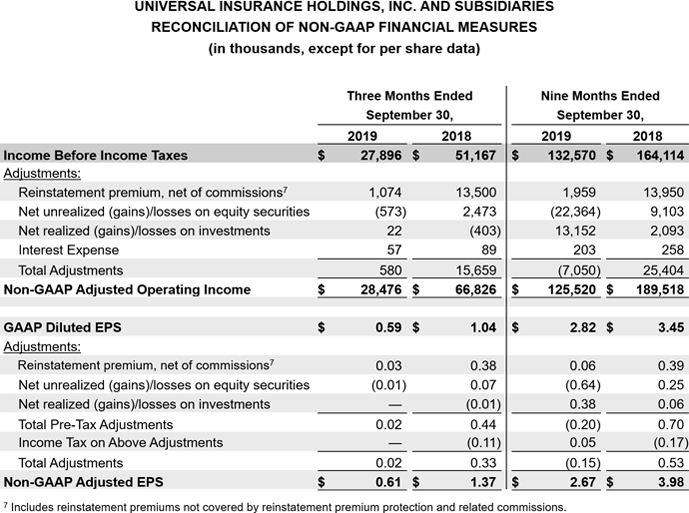

Summary Financial Results

2 Reconciliation of GAAP to non-GAAP financial measures are provided in the attached tables. Adjusted operating income excludes net realized and unrealized gains and losses on investments, interest expense, and extraordinary reinstatement premiums and associated commissions. Non-GAAP adjusted EPS excludes net realized and unrealized gains and losses on investments, as well as extraordinary reinstatement premiums and associated commissions.

Total revenue grew double digits for both the quarter and year-to-date periods, driven primarily by continued organic premium volume growth, pricing and investment portfolio performance. Income before income tax produced a 12.1% margin for the quarter, impacted by weather events above plan, partially offset by returns on our investment portfolio and integrated services performance. Year-to-date income before income tax produced an 18.9% margin. GAAP diluted EPS and non-GAAP adjusted EPS results for both the quarter and year-to-date reflect positive momentum from premium growth, investment performance and a reduced share count, offset by a higher core booked loss ratio (when compared to 2018), weather events above plan and a lower benefit from integrated services as prior years’ claims concluded. In addition, the year-to-date EPS decline relative to 2018 was driven by a pre-tax $6.5 million non-recurring benefit in policy acquisition costs in the second quarter of 2018. The Company produced a strong annualized year-to-date return on average equity of 23.9% and book value per share growth of 12.7% year-over-year.

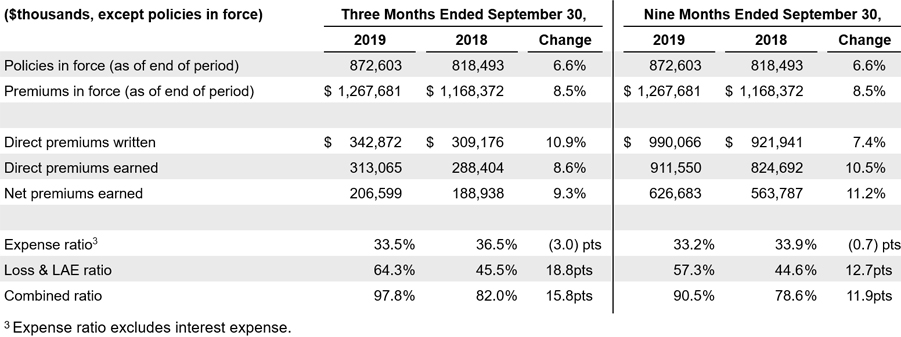

Underwriting

Direct premiums written were up double digits for the quarter, led by the full quarter’s impact of rate increases in Florida and other states taking effect, as well as strong direct premium growth of 27.6% in Other States (non-Florida). Year-to-date, direct premiums written were up 7.4% led by the rate increases, as well as strong direct premium growth of 29.1% in Other States.

On the expense side, the combined ratio increased 15.8 points for the quarter and 11.9 points year-to-date. The increases were driven primarily by increased losses in connection with the diversified growth in the Company’s underlying business, increased core booked loss ratio at the start of 2019, weather events above plan and a reduced benefit from our claims adjusting business, partially offset by a reduction in the expense ratio as set forth below:

- The expense ratio improved by 3 points for the quarter, primarily related to a 2.3 point improvement in the other operating expense ratio. Year-to-date, the expense ratio improved by 70 basis points. The year-to-date improvement was driven by a 1.7 point decrease in the other operating expense ratio, which was partially offset by a 90 basis point increase in the policy acquisition cost ratio.

-

- – The improvement in the other operating expense ratio for the quarter and year-to-date periods was due to economies of scale, executive compensation reductions, and higher reinstatement premiums in the prior year’s comparison, affecting the base of the ratio.

- – The increase in the policy acquisition cost ratio year-to-date relative to the first nine months of 2018 was due to a non-recurring benefit of $6.5 million recorded in the second quarter of 2018 related to a refund of prior year premium taxes as a result of a settlement with the Florida Department of Revenue, and higher reinstatement premiums in the prior year’s comparison, affecting the base of the ratio.

- The net loss and loss adjustment expense (“LAE”) ratio increased 18.8 points for the quarter and 12.7 points year-to-date. Quarterly and year-to-date drivers include:

-

- – Weather events in excess of plan of $15 million or 7.3 points ($7.5 million in 3Q18) for the quarter was related to weather events in Minnesota and a series of wind events in southeastern states, including Hurricane Dorian. Year-to-date, weather events in excess of plan were $22.0 million or 3.5 points ($12.5 million in YTD18).

- – Prior year reserve development of $3.2 million or 1.6 points for the quarter (immaterial in 3Q18) and $3.7 million or 60 basis points year-to-date ($2.2 million YTD18) were related to prior year’s catastrophe events.

- – All other losses and loss adjustment expense of $114.4 million or 55.4 points for the quarter, and $333.3 million or 53.2 points for the year-to-date period, were primarily related to diversified growth, an increase in our core booked loss ratio at the start of 2019, and a reduced benefit from our adjusting business as prior years’ claims concluded.

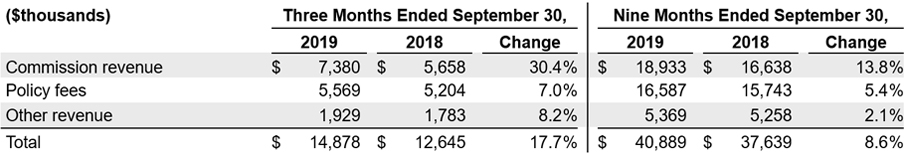

Services

Total services revenue increased 17.7% for the quarter and 8.6% year-to-date. The increase was driven by commission revenue earned on ceded premiums and an increase in policy fees and other revenue related to volume.

Investments

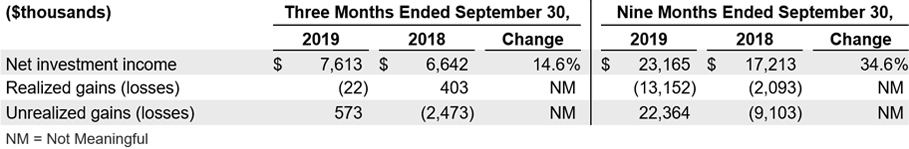

Net investment income increased 14.6% for the quarter and 34.6% year-to-date, primarily due to increased assets under management and an asset mix shift to higher yielding investment grade bonds during 2018 and 2019 which are having a greater impact on net investment income. Yields from the fixed income portfolio are dependent on future market forces, monetary policy and interest rate policy from the Federal Reserve. The Company continually monitors the current Federal Reserve interest rate trends, which has impacted effective yields on new fixed income and overnight cash purchases in 2019, but the impact has been somewhat limited, due to prudent duration strategies and asset mix shifts. Realized losses for the year-to-date period were primarily the result of liquidating underperforming equity securities. Unrealized gains were driven by market fluctuations in equity securities, resulting in a favorable outcome for the quarter and year-to-date periods.

Capital Deployment

During the third quarter, the Company repurchased approximately 964 thousand shares at an aggregate cost of $25.7 million. Year-to-date, the Company repurchased approximately 1.8 million shares at an aggregate cost of $49.9 million. The $49.9 million returned to shareholders through opportunistic share repurchases year-to-date is the largest amount of capital deployed for share repurchases over any other corresponding nine-month period in the Company’s history.

On June 5, 2019, the Board of Directors of the Company declared a quarterly cash dividend of 16 cents per share, which was paid in the third quarter on July 17, 2019, to shareholders of record as of the close of business on July 3, 2019.

Conference Call and Webcast

- Thursday, October 31, 2019 at 9:00 a.m. ET

- U.S. Dial-in Number: (855) 752-6647

- International: (503) 343-6667

- Participant code: 9183243

- Listen to live webcast and view presentation: UniversalInsuranceHoldings.com

- Replay of the call will be available on the UVE website and by phone at (855) 859-2056 or internationally at (404) 537-3406 using the participant code: 9183243 through November 14, 2019

About Universal Insurance Holdings, Inc.

Universal Insurance Holdings, Inc. (“UVE”) is a holding company offering property and casualty insurance and value-added insurance services. We develop, market, and write insurance products for consumers predominantly in the personal residential homeowners lines of business and perform substantially all other insurance-related services for our primary insurance entities, including risk management, claims management and distribution. We sell insurance products through both our appointed independent agents and through our direct online distribution channels in the United States across 18 states (primarily Florida). Learn more at UniversalInsuranceHoldings.com.

Non-GAAP Financial Measures

This press release contains non-GAAP financial measures within the meaning of Regulation G promulgated by the U.S. Securities and Exchange Commission (“SEC”), including adjusted earnings per diluted share, which excludes the impact of the net realized and unrealized gains and losses on investments as well as extraordinary reinstatement premiums and associated commissions. Extraordinary reinstatement premiums are not covered by reinstatement premium protection and attach just below the Florida Hurricane Catastrophe Fund (“FHCF”) reinsurance layer. Adjusted operating income excludes the impact of the net realized and unrealized gains and losses on investments, as well as interest expense and extraordinary reinstatement premiums and associated commissions. A “non-GAAP financial measure” is generally defined as a numerical measure of a company’s historical or future performance that excludes or includes amounts, or is subject to adjustments, so as to be different from the most directly comparable measure calculated and presented in accordance with generally accepted accounting principles (“GAAP”). UVE management believes that these non-GAAP financial measures, when considered together with the GAAP financial measures, provide information that is useful to investors in understanding period-over-period operating results separate and apart from items that may, or could, have a disproportionately positive or negative impact on results in any particular period. UVE management also believes that these non-GAAP financial measures enhance the ability of investors to analyze UVE’s business trends and to understand UVE’s performance. UVE’s management utilizes these non-GAAP financial measures as guides in long-term planning. Non-GAAP financial measures should be considered in addition to, and not as a substitute for or superior to, financial measures presented in accordance with GAAP.

Forward-Looking Statements

This press release may contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. The words “believe,” “expect,” “anticipate,” “will,” “plan,” and similar expressions identify forward-looking statements, which speak only as of the date the statement was made. Such statements may include commentary on plans, products and lines of business, marketing arrangements, reinsurance programs and other business developments and assumptions relating to the foregoing. Forward-looking statements are inherently subject to risks and uncertainties, some of which cannot be predicted or quantified. Future results could differ materially from those described, and the Company disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise. For further information regarding risk factors that could affect the Company’s operations and future results, refer to the Company’s reports filed with the Securities and Exchange Commission, including the Company’s Annual Report on Form 10-K.

Investor Relations Contact:

Rob Luther 954-958-1200 Ext. 6750

VP, Corporate Development, Strategy & IR

rluther@universalproperty.com

Media Relations Contact:

Andy Brimmer / Mahmoud Siddig 212-355-4449

Joele Frank, Wilkinson Brimmer Katcher